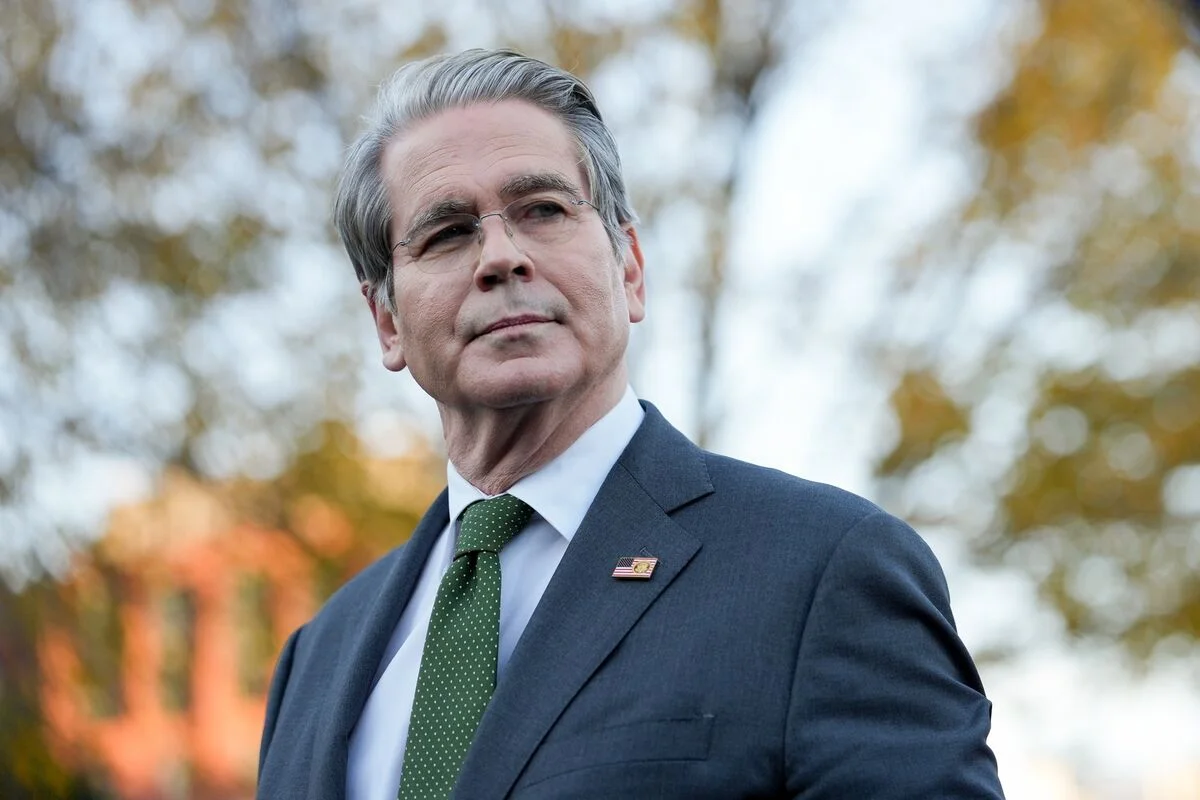

Economist Kevin Hassett Praises Inflation Data and Predicts Record Tax Refunds for 2026

Kevin Hassett discusses the US economy, asserting that recent job and inflation data indicate stability and room for rate cuts, while addressing immigration policy changes, tariffs, and oil market concerns, emphasizing positive economic trends and policy clarity for 2026.