Politicseconomy News

The latest politicseconomy stories, summarized by AI

Featured Politicseconomy Stories

Trump Promises $2,000 Tariff Dividend for Americans

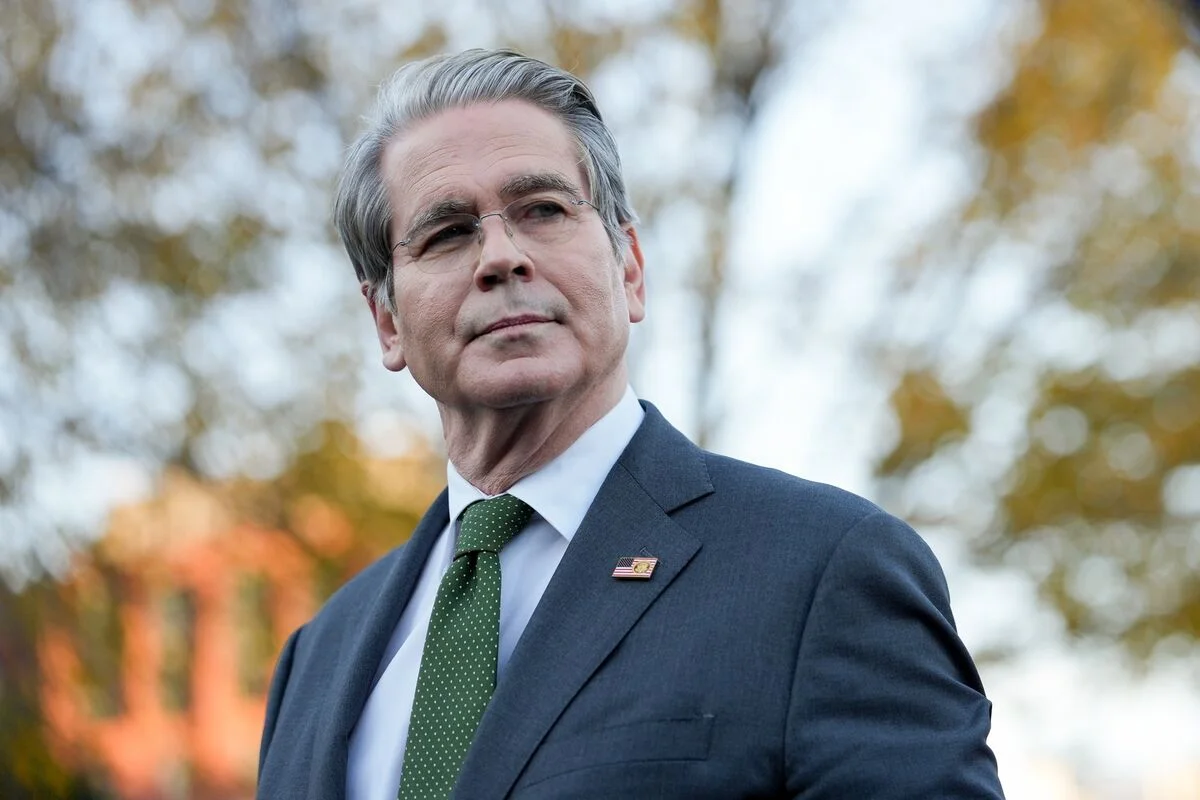

Treasury Secretary Scott Bessent indicated that the $2,000 'dividend' promised by President Trump could be delivered through various tax cuts, including reductions on tips, overtime, and Social Security, as part of the administration's economic policies. The discussion comes amid ongoing debates over tariffs and their impact on the US economy and debt reduction efforts.

More Top Stories

White House hints at tariff deadline extensions amid ongoing trade negotiations

ABC News - Breaking News, Latest News and Videos•7 months ago

UK's Reeves Announces $2.7 Trillion Spending Plan for National Renewal

Reuters•8 months ago

More Politicseconomy Stories

Doubts Mount Over Trump's Ability to Fix the National Debt

President Trump faces skepticism over his multitrillion-dollar tax cuts and spending package, with concerns about increasing the national debt, rising interest rates, and whether economic growth will be sufficient to offset the deficits. Experts and some politicians doubt the plan's effectiveness in reducing debt, highlighting potential long-term fiscal challenges and political opposition.

Trump Considers Jamie Dimon for Treasury, Signals Support for Fed's Powell

Donald Trump has cautioned the US Federal Reserve Chair against cutting interest rates before the upcoming election, suggesting that such a move could have political implications.

Trump Pledges to Keep Fed Chair Powell if Reelected

Former President Donald Trump stated he would allow Federal Reserve Chair Jerome Powell to complete his term if he wins the November election, despite previously criticizing Powell's interest rate policies and suggesting he would not reappoint him.

"Modi Wins Third Term with Reduced Mandate, Wall Street Reacts"

Indian Prime Minister Narendra Modi's failure to secure a supermajority in the recent elections has caused significant concern among business executives and investors, both domestically and internationally. The unexpected results have led to a sharp decline in the Indian stock market and raised questions about the future of Modi's economic reforms. U.S. companies, heavily invested in India as an alternative to China, may need to adjust their expectations. Despite the political setback, experts believe India's long-term economic potential remains strong, though the pace of reforms may slow under a coalition government.

"India Stocks Plunge Amid Modi's Narrow Election Victory"

Indian Prime Minister Narendra Modi's ruling coalition is set to retain power, but his party lost its outright majority, causing Indian stocks and ETFs to fall sharply. Investors are concerned about potential policy uncertainty as Modi will now rely on support from regional parties. Despite the market reaction, analysts believe there will be continuity in government policies.

India Stocks Surge to Record Highs on Modi Election Predictions

Investors are optimistic about a third term for Prime Minister Narendra Modi, as exit polls predict a landslide victory for his Bharatiya Janata Party. This has led to a significant rally in Indian stock markets, with the NSE Nifty 50 Index surging 3.3% and the rupee performing strongly. The anticipated win is expected to enable Modi's government to continue its economic policies, boosting growth and investor confidence.

Indian Stocks Soar to Record Highs on Landslide Modi Win Predictions

Indian stocks, bonds, and the rupee are expected to rise as exit polls suggest a landslide victory for Prime Minister Narendra Modi's party in the general elections, with the BJP-led alliance projected to win between 350 and 400 seats.

"Trump's Potential Return Poses Threat to Fed Independence: Poll"

A Bloomberg survey indicates that a potential second term for Donald Trump poses a significant risk to the Federal Reserve's independence, with 44% of respondents expecting increased political interference. This could destabilize financial markets, particularly the bond market, and undermine investor confidence. The survey highlights the high stakes of the upcoming election, with contrasting approaches from Trump and Biden regarding the Fed's autonomy.

"Biden's Plan to Secure Social Security: What It Means for Your Retirement"

President Joe Biden is committed to strengthening Social Security without cutting benefits or privatizing the program, proposing higher taxes on the wealthy. However, this solution may require significant tax code changes. An alternative proposal, raising the full retirement age (FRA), could help avoid benefit cuts but may force many workers to delay retirement, impacting their financial plans.

"Biden's Mixed Strategy on China Tariffs and EV Competition"

President Biden's decision to impose a 100% tariff on Chinese electric vehicles (EVs) is criticized as a historical misstep, drawing parallels to the 1970s OPEC Oil Crisis and the rise of Japanese automakers. The article argues that instead of blocking affordable Chinese EVs, the U.S. should allow them to be manufactured domestically, benefiting the majority of Americans and supporting climate goals. The tariff is seen as driven by union pressures, Sinophobia, and a need for an external enemy, rather than economic or environmental considerations.