Impact of SNAP Benefit Cuts on Consumers, Retailers, and Walmart

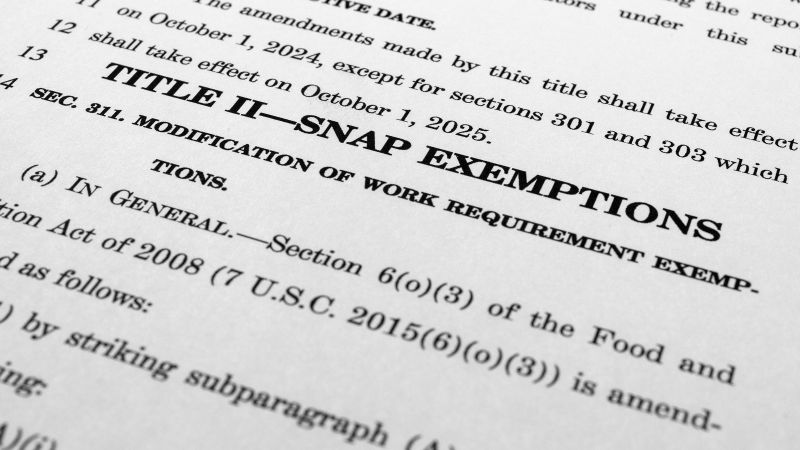

A potential lapse in SNAP benefits due to the ongoing U.S. government shutdown could severely impact 42 million Americans relying on food assistance, leading to increased food insecurity, reduced consumer spending, and financial strain on retailers, especially those heavily dependent on SNAP shoppers like Walmart and Dollar General. The situation could also affect retail sales and employment in the sector, with some states beginning to offer interim aid.