U.S. debt climbs by nearly $700B in four months, per CBO

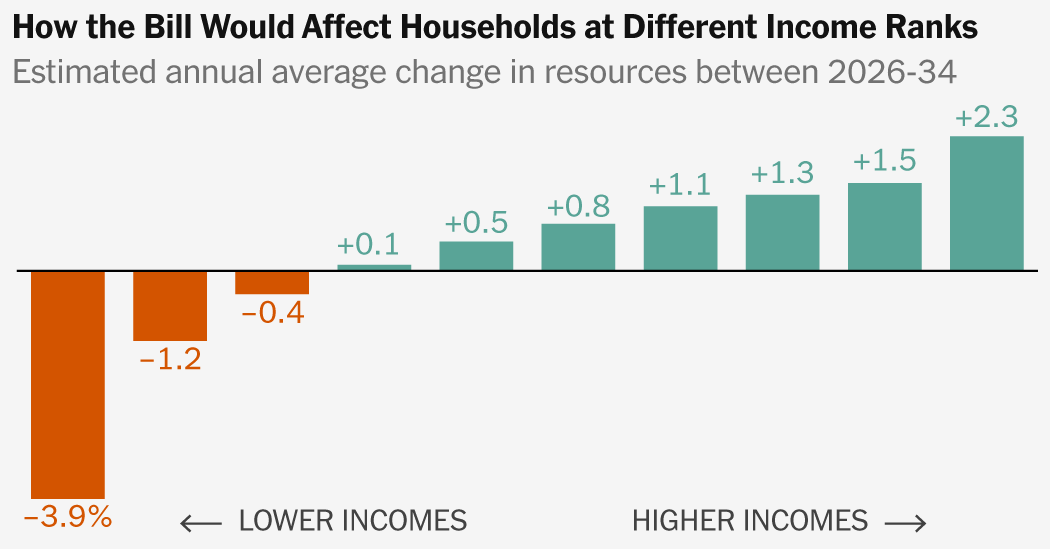

New data from the Congressional Budget Office show the U.S. added about $696 billion to the national debt over four months, borrowing $94 billion in January alone. The debt now sits near $38 trillion, about 100% of GDP—the highest postwar level—raising the risk of a financial crisis if deficits aren’t tamed. While rising spending is a factor, the GOP’s budget reconciliation bill also boosted corporate deductions, contributing to lower tax revenue. Net interest payments reached a record of over $1 trillion in FY2025. The report warns that sustained deficits could fuel inflation, higher interest rates, slower growth, and potential national security implications.