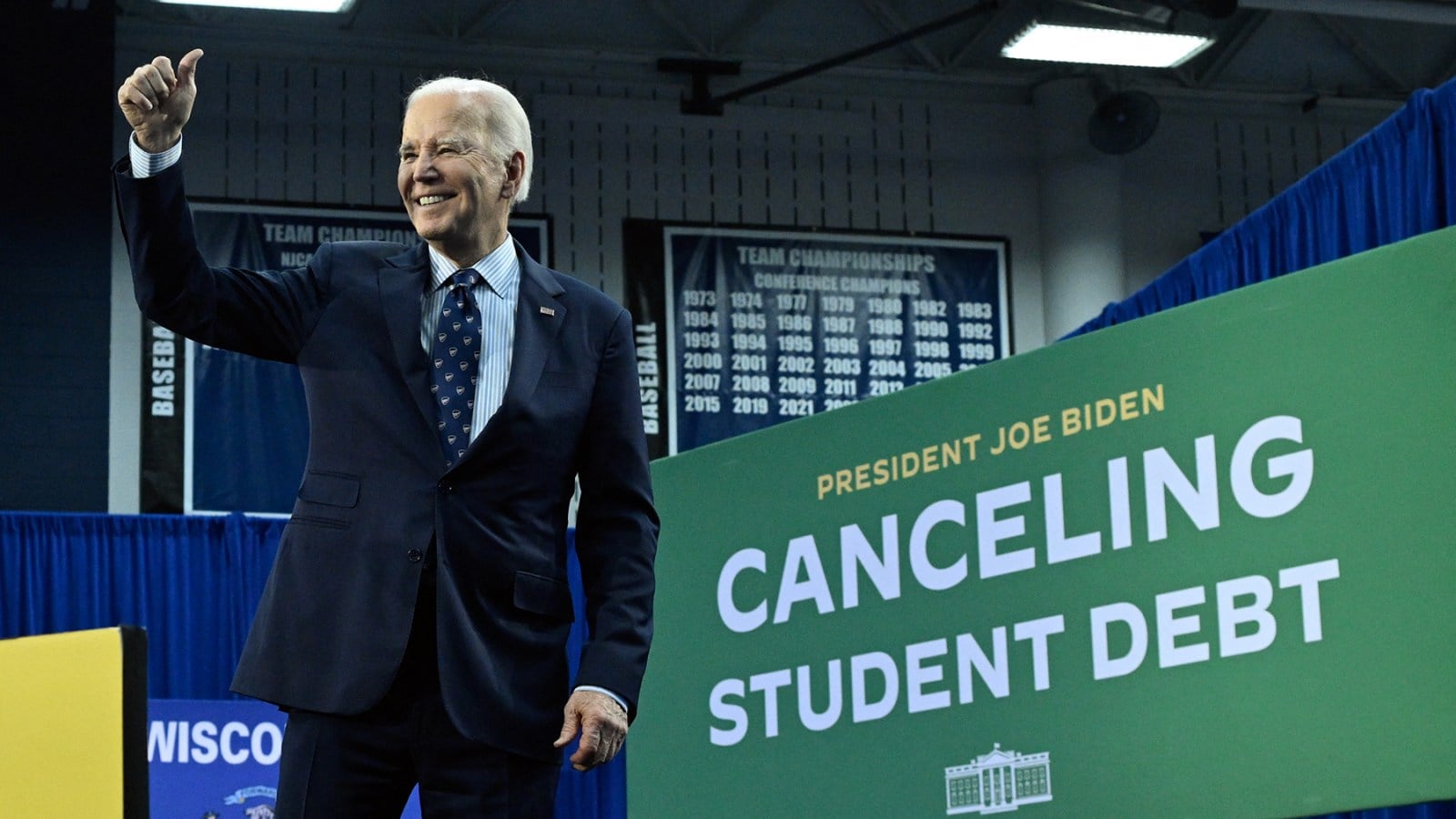

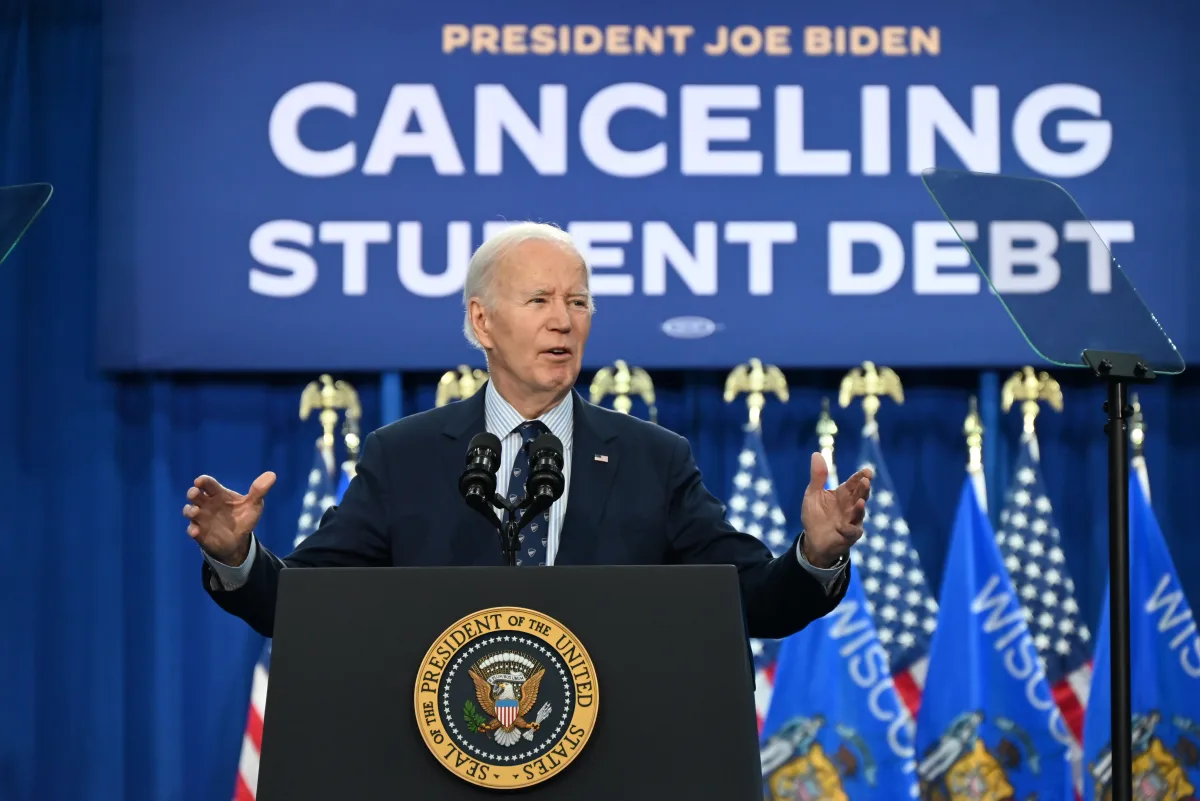

Rising Student Loan Debt and Missed Payments Threaten Borrowers' Financial Stability

Many federal student loan borrowers are unaware of available relief programs like income-based repayment plans and loan forgiveness, leading some to pay more than necessary; increasing awareness and understanding of these options can help borrowers manage and reduce their debt effectively.