AOC Champions Working-Class Vision at Munich, Faces Foreign-Policy Hurdles

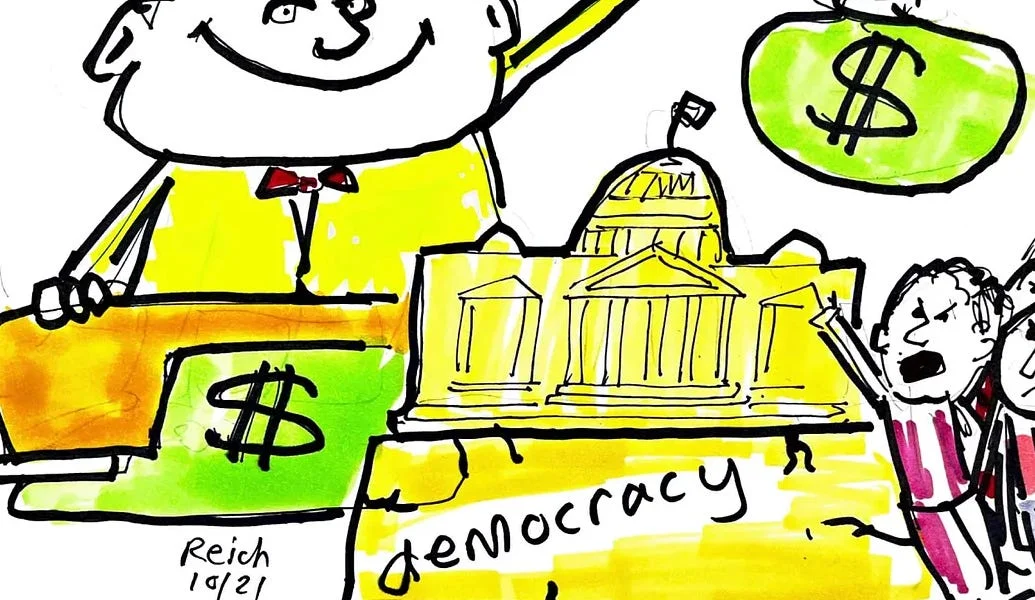

At Munich Security Conference, Ocasio-Cortez linked rising income inequality to the appeal of authoritarians and urged stronger Western alliances and domestic reforms, but faltered on foreign-policy specifics like Taiwan and Iran, underscoring her economic focus and relative inexperience on international crises.