Debt at 100% of GDP: CRFB warns of looming fiscal crises if debt outpaces growth

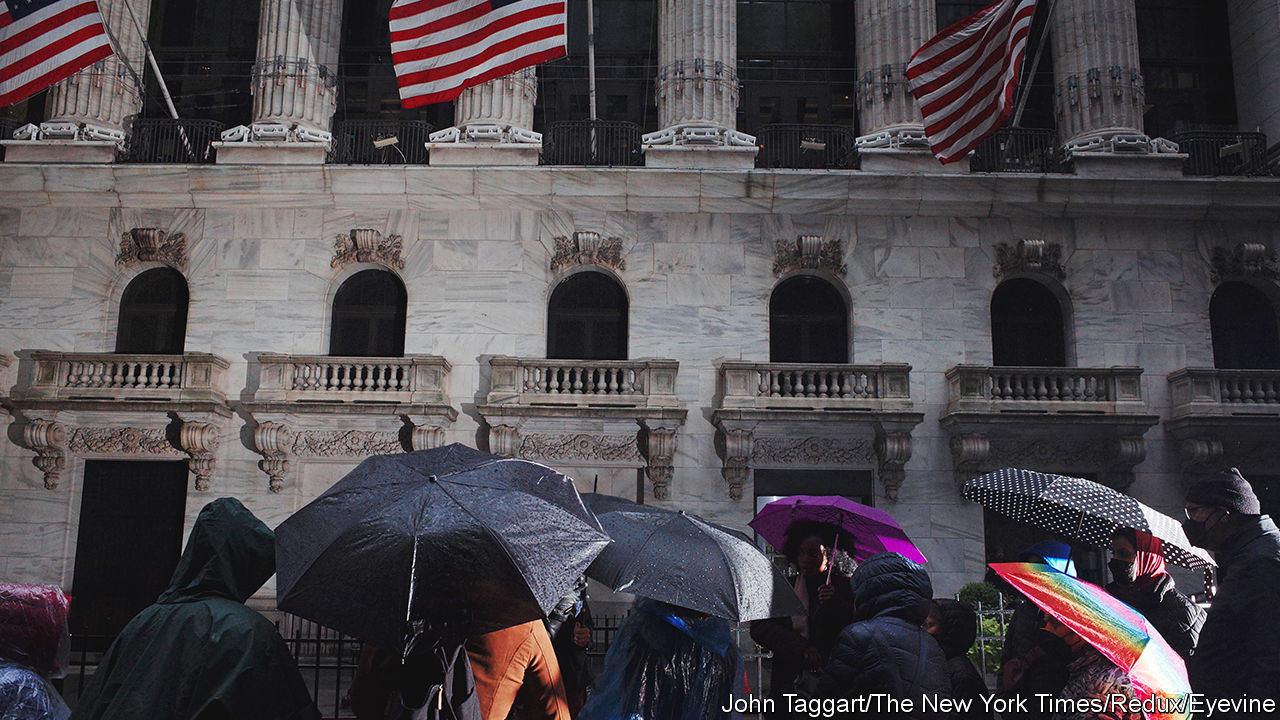

The U.S. national debt has reached 100% of GDP, and a Committee for a Responsible Federal Budget study warns that debt growing faster than the economy could trigger multiple crises—financial, inflation, currency, default, austerity, or a gradual downturn—unless policymakers adopt a pro-growth deficit-reduction plan. The report notes debt-service costs near $1 trillion annually (about 18% of federal revenue), leaving limited fiscal space. It cites Greece’s austerity episodes as cautionary examples and warns that rapid cuts during a weak economy could deepen a recession; triggers include a debt-ceiling breach, weak Treasury auctions, or a recession.