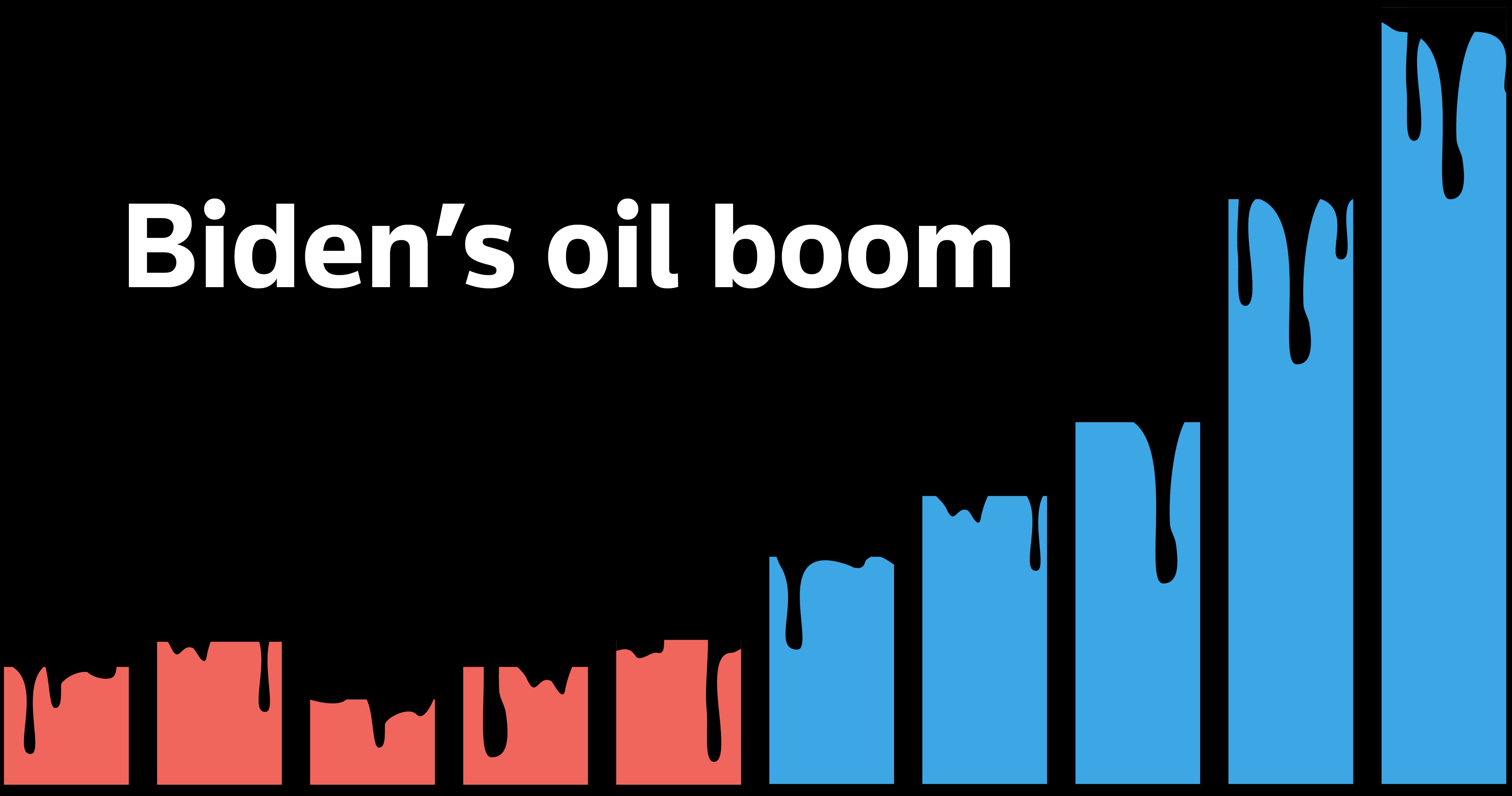

US Drilling Activity Tapers as Oil Prices Rally, Rig Count Falls to 550

U.S. active drilling rigs fell to 550 this week (down 43 YoY), with oil rigs at 407 and gas rigs at 134. Weekly crude production slipped 33,000 bpd to 13.702 million bpd. In the Permian, rigs rose by 1 to 240 while Eagle Ford kept at 40. Oil prices advanced ahead of the data, with Brent around $72.49/b and WTI near $66.61, helping explain the pause in drilling.