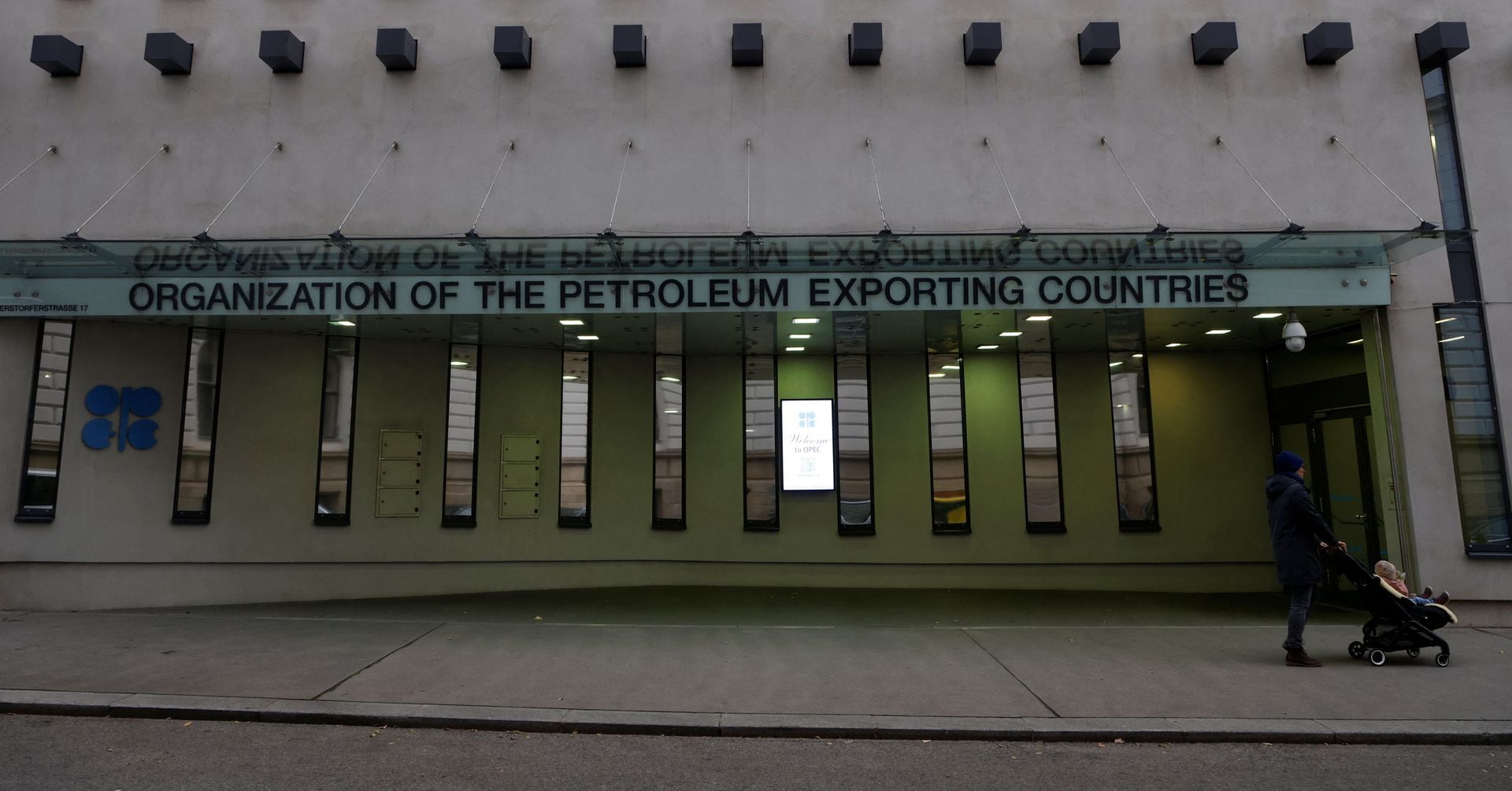

OPEC+ Likely to Extend Oil Cuts Through 2025 Amid Price Struggles

OPEC+ has decided to extend its significant oil production cuts into 2025 to stabilize the market amid weak demand growth, high interest rates, and increasing U.S. production. The group will gradually phase out some cuts starting in October 2024, while postponing discussions on individual member capacity targets until November 2025. This move aims to address market concerns and maintain solidarity within the group.