Bessent Warns of Recession Risks Amidst Fed Rate Hikes and Dollar Rise

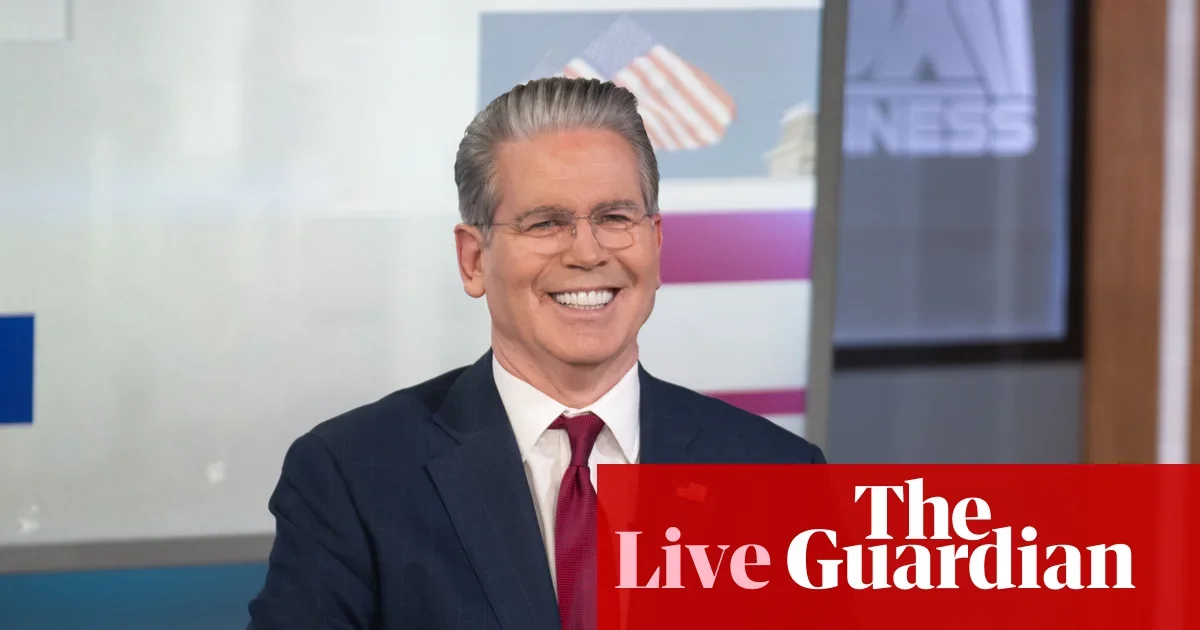

U.S. Treasury Secretary Scott Bessent suggests that high interest rates have caused parts of the economy, especially housing, to enter recession, with low-end consumers hit hardest; he advocates for faster Federal Reserve rate cuts to stimulate growth, amid debates on the appropriate monetary policy stance.