Chinese Stocks Slip Amid Economic Concerns and Market Uncertainty

Chinese stocks declined due to weak economic data, reflecting concerns about the country's economic outlook.

All articles tagged with #chinese stocks

Chinese stocks declined due to weak economic data, reflecting concerns about the country's economic outlook.

Chinese stocks, including Alibaba, Baidu, and JD.com, fell sharply following disappointing economic data and a warning from President Xi Jinping against reckless growth and local government spending, suggesting potential limits on future stimulus measures despite weak economic indicators like slow retail sales and falling investment. The market decline reflects concerns over China's economic outlook amid Xi's emphasis on high-quality, sustainable development, with major indices and stocks experiencing notable drops.

Chinese stocks rose approximately 0.5% on the back of a policy readout emphasizing technological self-reliance and the upcoming Xi-Trump meeting, boosting investor confidence in China's tech industry and economic prospects, with notable gains in chip and AI-related shares.

China aims to adopt a long-term approach in its relationship with the U.S., which could influence the performance and strategy of Chinese stocks, emphasizing patience and strategic planning in the evolving geopolitical landscape.

Chinese stocks declined due to renewed US-China trade tensions, with the Hang Seng China Enterprises Index dropping over 2%, while the yuan remained steady and bond futures rose, reflecting investor jitters but also opportunities for buying the dip amid ongoing trade negotiations and economic developments.

Asian markets, led by Chinese stocks, declined due to renewed trade tensions between China and the U.S., with both countries imposing and threatening new tariffs, causing investor concern and market volatility.

The prospect of a renewed US-China trade war, with threats of increased tariffs and export controls, has caused Chinese stocks and the yuan to decline, threatening the year's rally and adding uncertainty to global markets, though some analysts believe the market may rebound after initial declines.

Chinese stocks listed in the U.S. fell sharply after Donald Trump threatened to increase tariffs on Chinese imports and accused China of holding the world 'captive' through rare earth metals, reflecting renewed tensions between the two countries amid ongoing trade and security disputes.

Cathie Wood's Ark Investment Management has reopened its positions in Alibaba for the first time in four years, investing around $16.3 million as Alibaba's stock hits a multiyear high driven by optimism over its AI initiatives, signaling a potential comeback in Chinese internet stocks after previous sector setbacks.

Cathie Wood's Ark Invest is buying Chinese stocks, including Alibaba, Pony AI, and Baidu, as she sees potential in China's growing market despite mixed recent performances, with investments focusing on e-commerce, autonomous driving, and AI chips.

Chinese stocks have fallen to a 5-month low amid comments from Xi Jinping targeting overvalued markets, signaling potential regulatory or economic concerns.

Chinese stocks experienced their largest decline in five months, reflecting recent market volatility and investor concerns.

Asian equities slowed amid a Chinese stock selloff and US job data fueling expectations of Fed rate cuts, while bond markets and commodities experienced notable movements, reflecting global economic concerns and policy responses.

Asian stocks mostly remained flat or declined, with technology shares falling sharply due to weak U.S. and regional cues, including profit-taking and concerns over U.S. interest rate hikes. Japan's markets declined further from record highs amid disappointing trade data, while Chinese stocks gained on stable interest rates and positive trade prospects. The overall sentiment was influenced by global economic data, U.S.-China relations, and geopolitical developments.

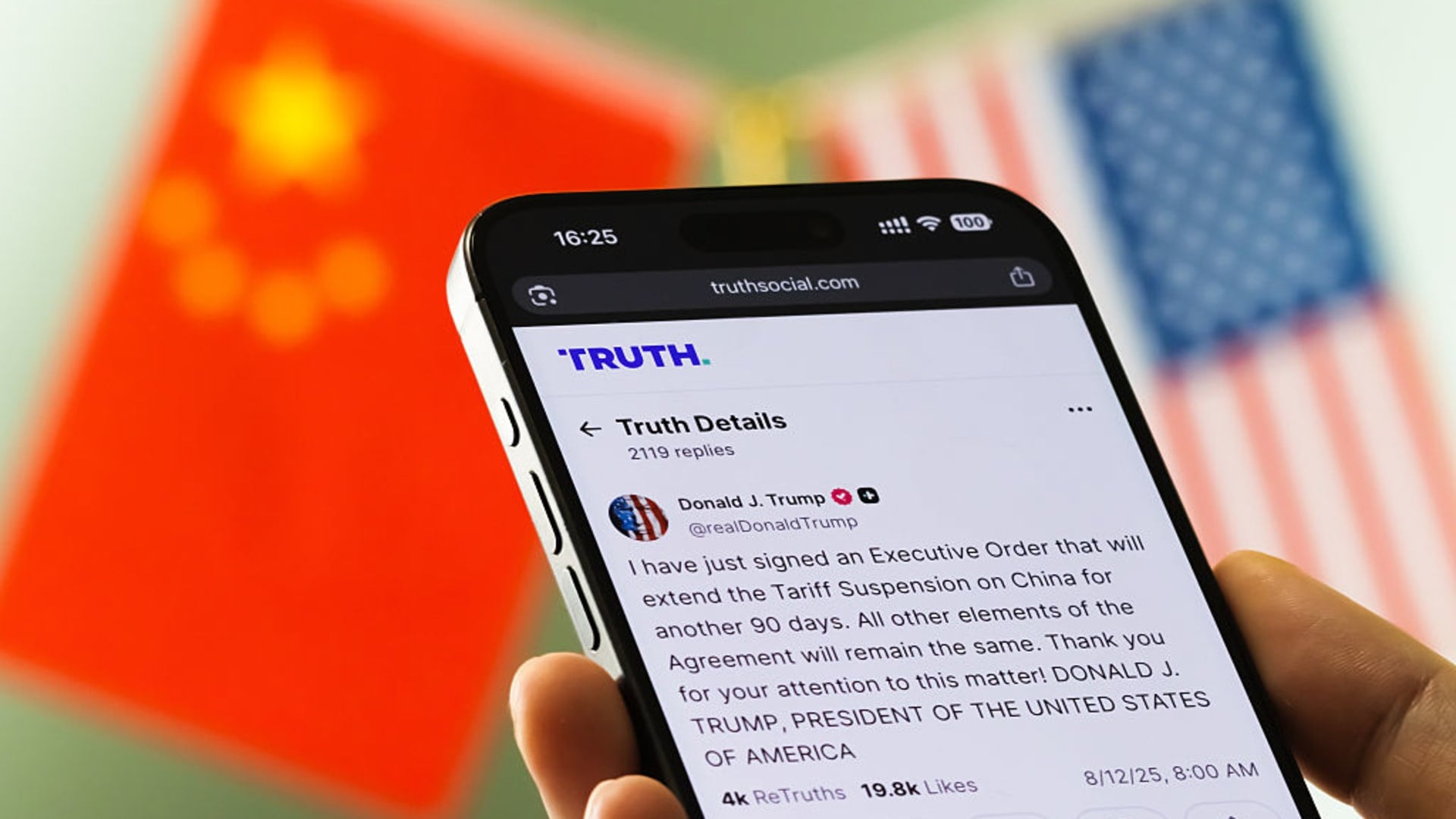

Chinese stocks, including Xiaomi, Tencent, and others, are approaching buy points amid hopes of an extension of the US-China trade truce, with Xiaomi's EV sales and earnings growth highlighting its competitive position against Tesla.