Altman's Winning Streak Hits Reality as OpenAI's Ambitions Expand

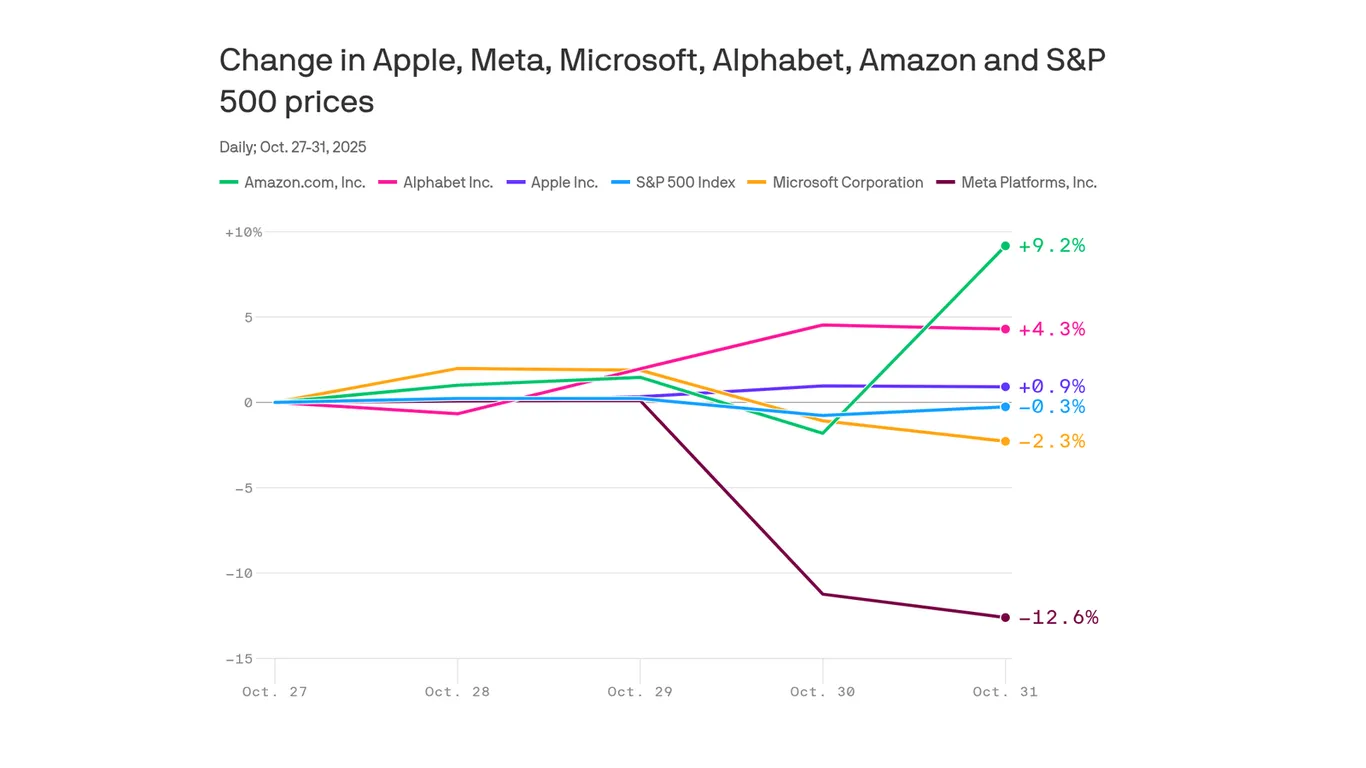

A Forbes profile frames Sam Altman as a master at getting what he wants, a dynamic underscored by OpenAI's public friction with Nvidia and a revenue/partnership model backed by Microsoft, Nvidia, and others. The company has pursued a wide range of bets—AI wearables with Jony Ive and hundreds of investments—while insiders warn this pace risks losing focus. With Nadella disputing near-term AGI and concerns about cash burn by 2027, Altman may finally face 'no' as he pushes ahead.