Fed Minutes Reveal Deep Divisions Over Future Rate Cuts

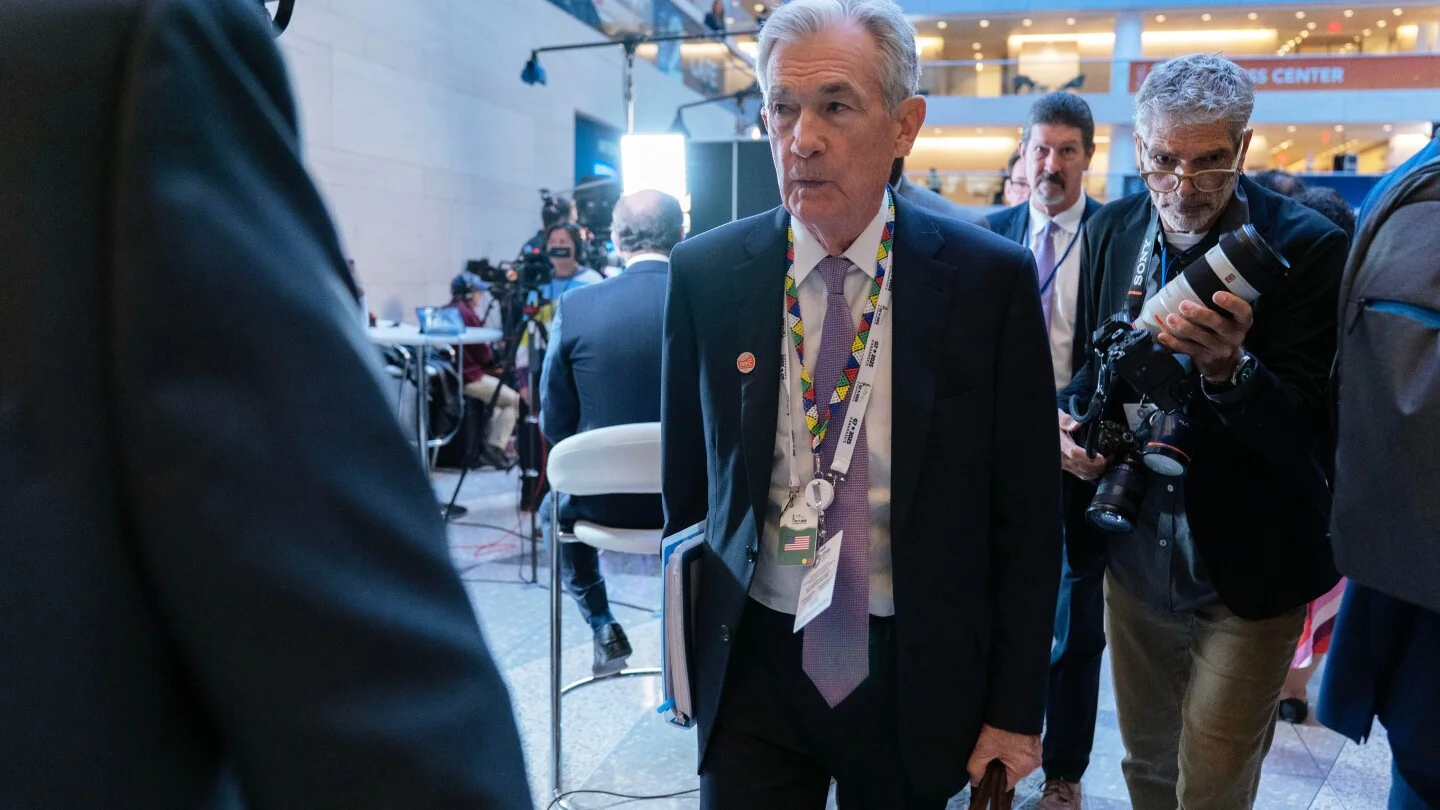

The December interest rate cut by the Federal Reserve was a close call, with significant divisions among officials over whether to cut or hold rates, influenced by concerns over a weak job market and persistent inflation, amid delayed economic data due to a government shutdown.