US GDP Surge Sparks Rate Cut Speculation Amid Holiday Party Drama

US GDP grew faster than expected in Q3, which could influence the Federal Reserve's decisions on interest rate cuts in 2026, indicating a robust economic outlook.

All articles tagged with #third quarter

US GDP grew faster than expected in Q3, which could influence the Federal Reserve's decisions on interest rate cuts in 2026, indicating a robust economic outlook.

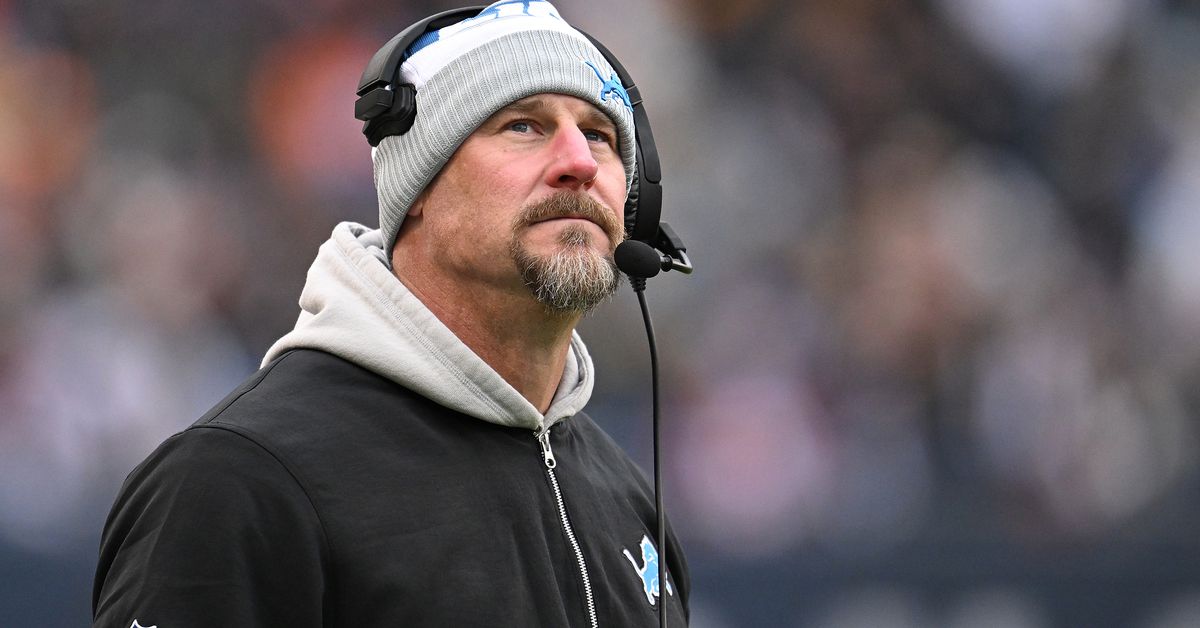

The Detroit Lions have been plagued by three major issues: turnovers, poor coverage in the secondary, and a consistent struggle in the third quarter. While some of these problems may be fixable, such as improving the offensive line and regressing to a below-average passer under pressure, the Lions face upcoming games against teams known for pressuring the quarterback and forcing turnovers. The Lions' secondary has been a weak point all season, and it's uncertain if personnel changes will provide stability. Additionally, the Lions have been abysmal in the third quarter, and despite efforts to address the issue, it remains a persistent problem.

The US economy grew at an annualized rate of 5.2% in the third quarter, surpassing the initial estimate of 4.9%, indicating its resilience despite inflation and high borrowing costs. However, experts predict a slower growth rate in the coming months as pandemic savings decrease and interest rates remain high.

American households increased their total debt by $78 billion in the third quarter of 2023, with the average amount owed at $145,319. The report projects that U.S. households will end the year with over $350 billion more debt than they started with. The collective debt owed by U.S. households is $17.3 trillion, with mortgage debt increasing by $20 billion and credit card debt reaching around $1.08 trillion in the third quarter.

HSBC's post-tax profit for the third quarter surged over 235% year-on-year to $6.26 billion, with revenue rising to $7.71 billion, compared to $2.66 billion and $3.23 billion respectively in the same period last year. For the nine months ending in September, profit after tax reached $24.33 billion, compared to $11.59 billion in the first nine months of 2022. HSBC's Hong Kong-listed shares increased by 0.43% following the announcement.

The US economy is expected to have grown by 4.3% in the third quarter, according to forecasts. This indicates a significant rebound from the sharp contraction experienced earlier this year due to the COVID-19 pandemic. The growth is attributed to increased consumer spending and business investment, as well as government stimulus measures. The GDP figures for the third quarter will provide insights into the pace of recovery and the overall health of the US economy.

SolarEdge Technologies, a global leader in smart energy technology, announced preliminary unaudited financial results for the third quarter of 2023. The company experienced unexpected cancellations and pushouts of existing backlog from European distributors, resulting in lower-than-expected revenue, gross margin, and operating income. Third quarter revenue is now expected to be in the range of $720 million to $730 million, compared to the previous expectation of $880 million to $920 million. The company also anticipates significantly lower revenues in the fourth quarter as the inventory destocking process continues.

China's economy grew by 4.9% in the third quarter, indicating a continued recovery from the impact of the COVID-19 pandemic. This growth, driven by increased consumer spending and industrial production, provides a positive outlook for the global economy and highlights China's role as a major player in the post-pandemic recovery.

Goldman Sachs is set to release its third-quarter earnings, with a focus on its investment banking roots, as it aims to recover from a consumer exit and demonstrate its commitment to the industry.

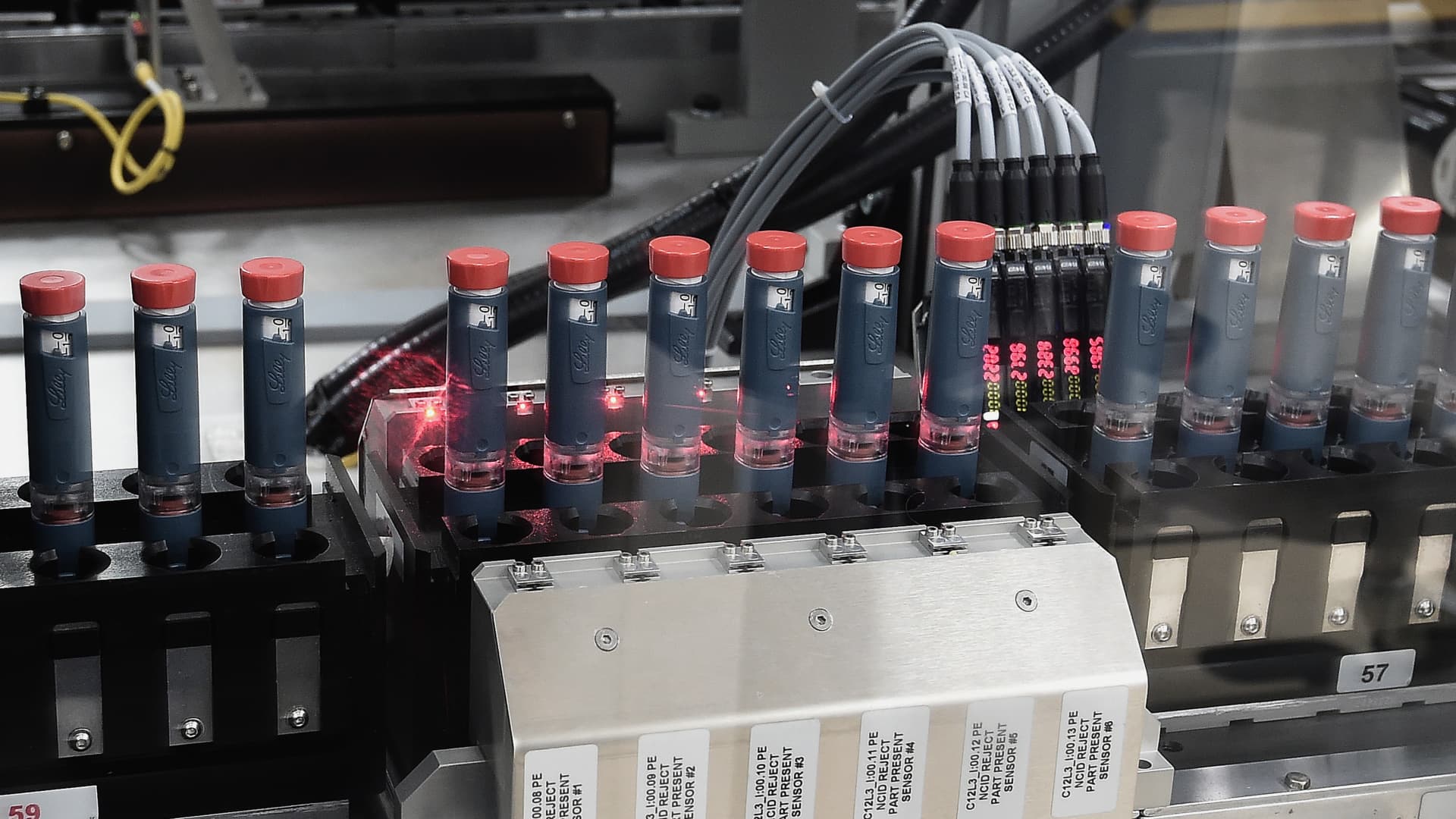

The third quarter of the year proved to be challenging for the stock market, with September historically being the worst month for stocks. Wall Street experienced a decline during this period, impacting various club stocks. While some club stocks performed well, such as Eli Lilly, others struggled to maintain their value.

The stock market closed the third quarter with losses, breaking three straight quarters of gains for the Dow and S&P 500. The Nasdaq also retreated after two consecutive quarters of advances. Despite the declines, all three benchmarks have performed well year to date, and investors are optimistic about the fourth quarter, which historically tends to be the best-performing quarter.

JetBlue Airways stock fell 7.6% after the company announced that it does not anticipate posting a profit in the third quarter.

Despite a wave of positive regulatory developments, Bitcoin is currently experiencing a lull in activity during the summer doldrums. Standard Chartered predicts a potential upside to its 2024 bitcoin target of $100,000, but a challenging macro backdrop may dampen bitcoin's growth in the third quarter. The cryptocurrency industry is also working to address its custody problem as institutional investors enter the market and regulatory uncertainty persists.

As the third quarter begins, there are significant uncertainties surrounding the economy, including concerns about inflation, job growth, and earnings.

The last quarter moon of July will be in its half-lit third-quarter phase tonight, rising from the eastern horizon shortly after midnight and setting to the west around 1 p.m. ET on Sunday. The best time to view the moon will be between 5 a.m. and 7 a.m. ET. Skywatchers should take precautions not to point any optics in the direction of the sun during a daytime observation. Following the third-quarter moon, the new moon will occur on July 17, providing an excellent opportunity for stargazing.