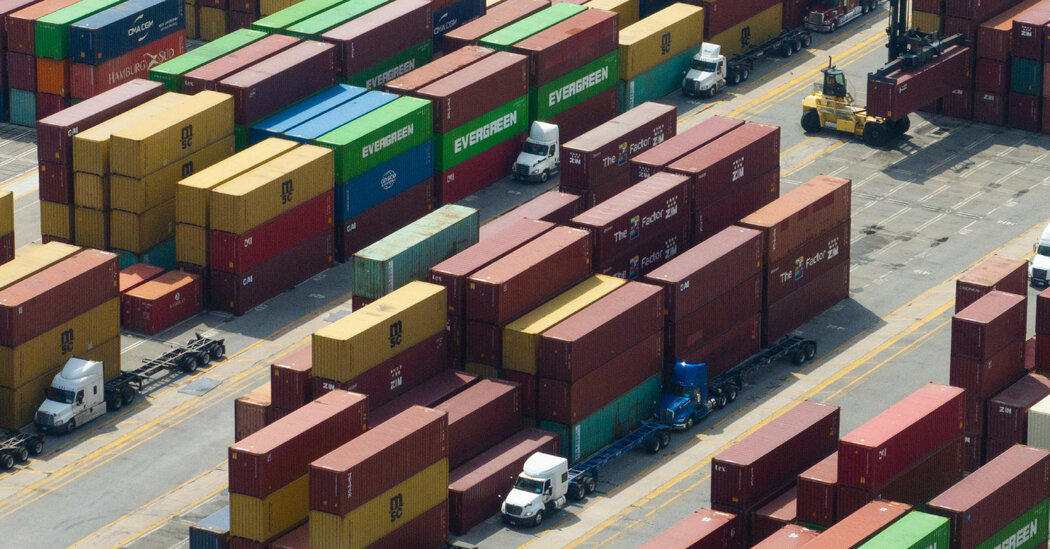

US reduces proposed tariffs on Italian pasta

The US has significantly reduced proposed tariffs on Italian pasta imports from nearly 92% to as low as 2.26% for some companies, following negotiations with Italian firms, avoiding steep price hikes for US consumers and easing political tensions.