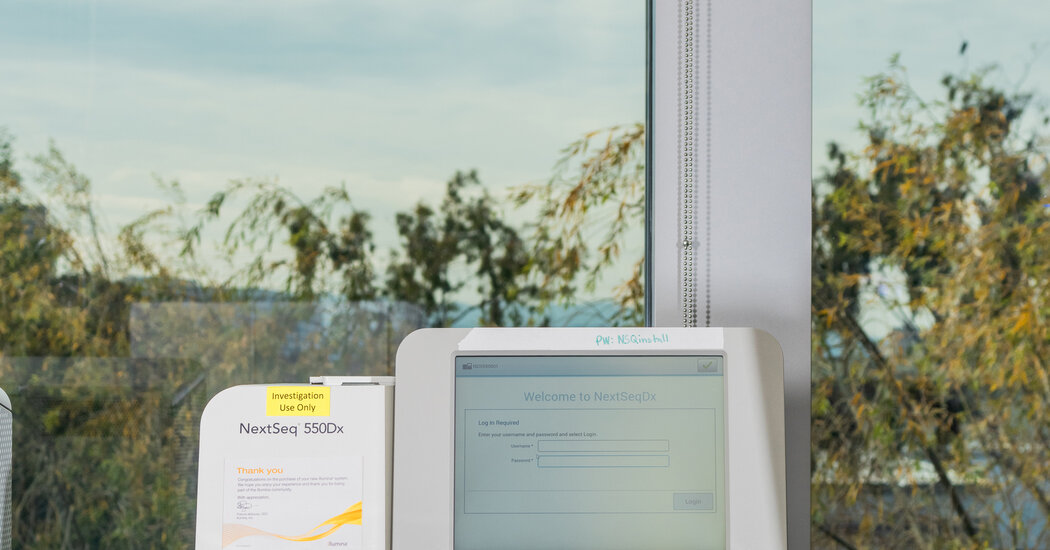

Grail stock slumps after NHS Galleri trial misses primary endpoint

Grail's stock fell more than 45% after-hours after NHS-Galleri trial failed to meet its primary endpoint, showing no statistically significant reduction in later-stage cancers overall; however, a pre-specified group of 12 deadly cancers showed a favorable trend toward fewer stage III-IV cancers, with greater reductions in stage IV diagnoses across sequential screening rounds. The company will extend follow-up by 6-12 months to seek stronger effects, and it also reported 17% full-year revenue growth to $147.2 million, with U.S. Galleri revenue up 26% to $136.8 million.