China Drives the Clean-Energy Era as the U.S. Pulls Back

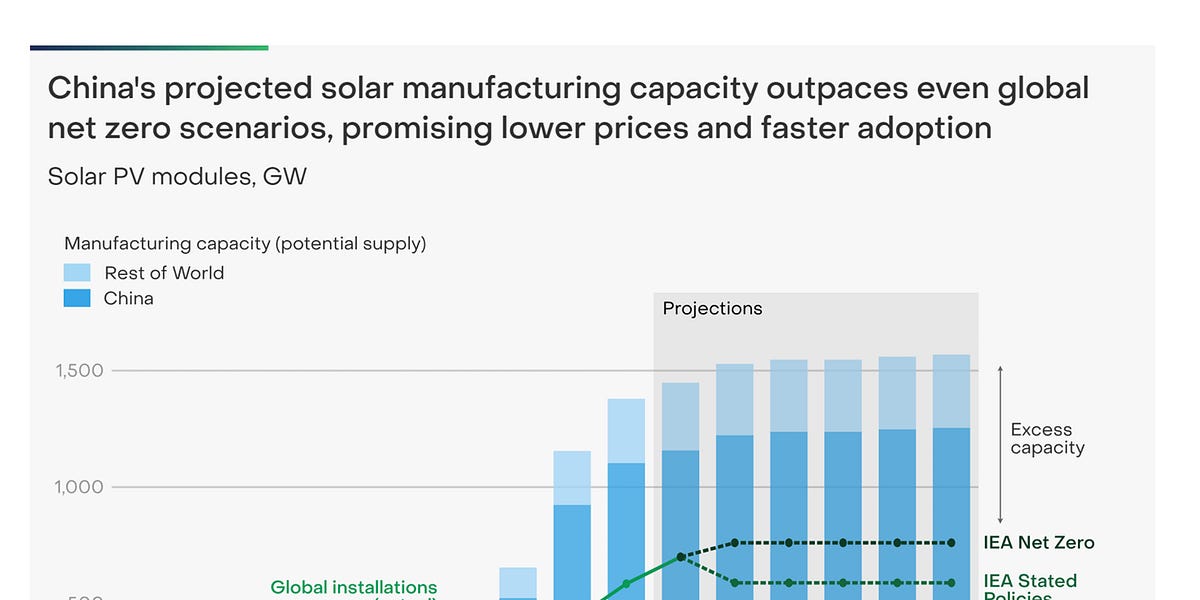

China has emerged as the dominant force in the global energy transition, leading in renewable deployment and low-carbon tech while the United States withdraws from climate leadership; yet China still relies on coal for reliability and tightly controls critical minerals and processing, creating security and dependency questions for Western economies as they race to catch up.