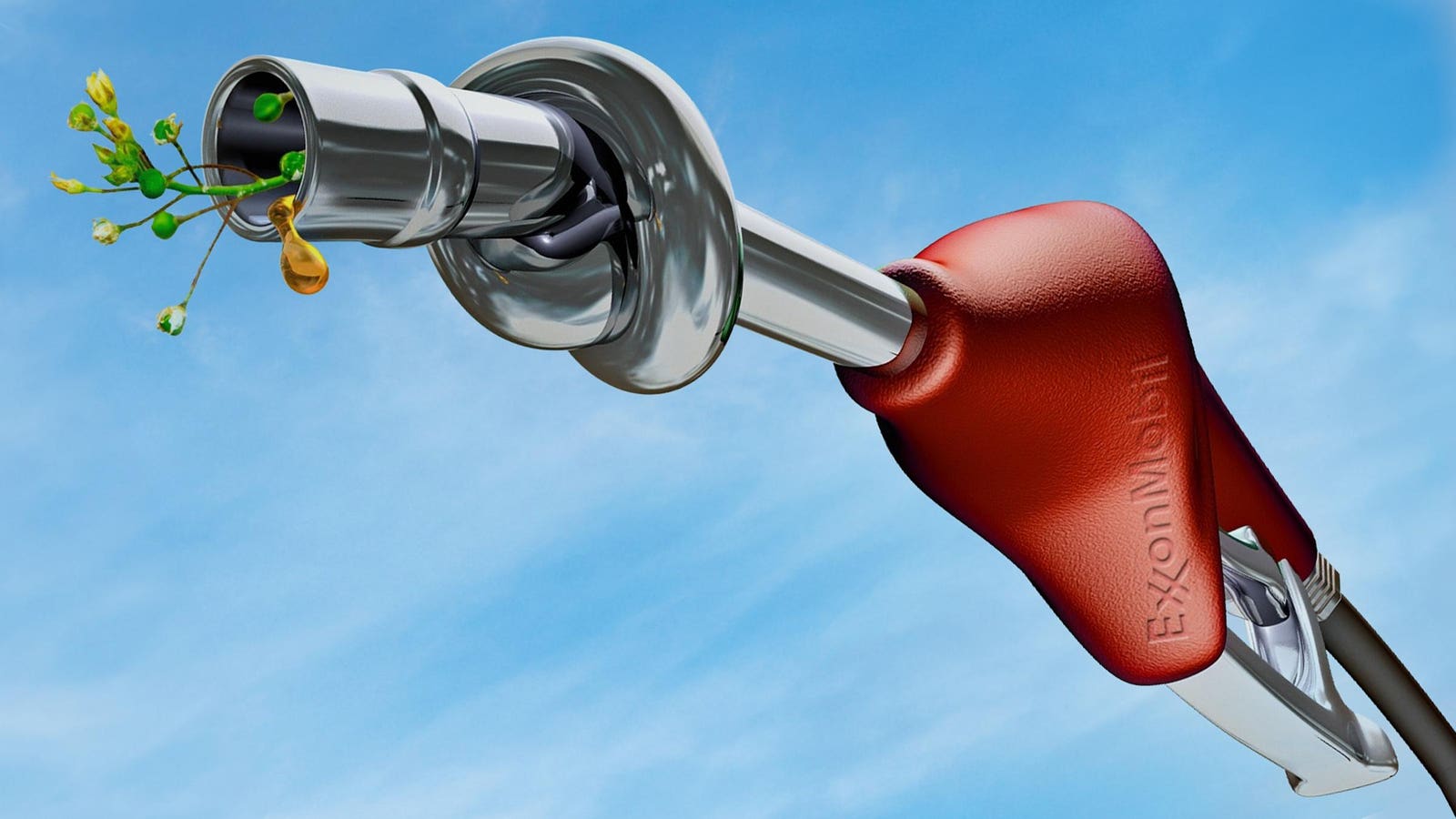

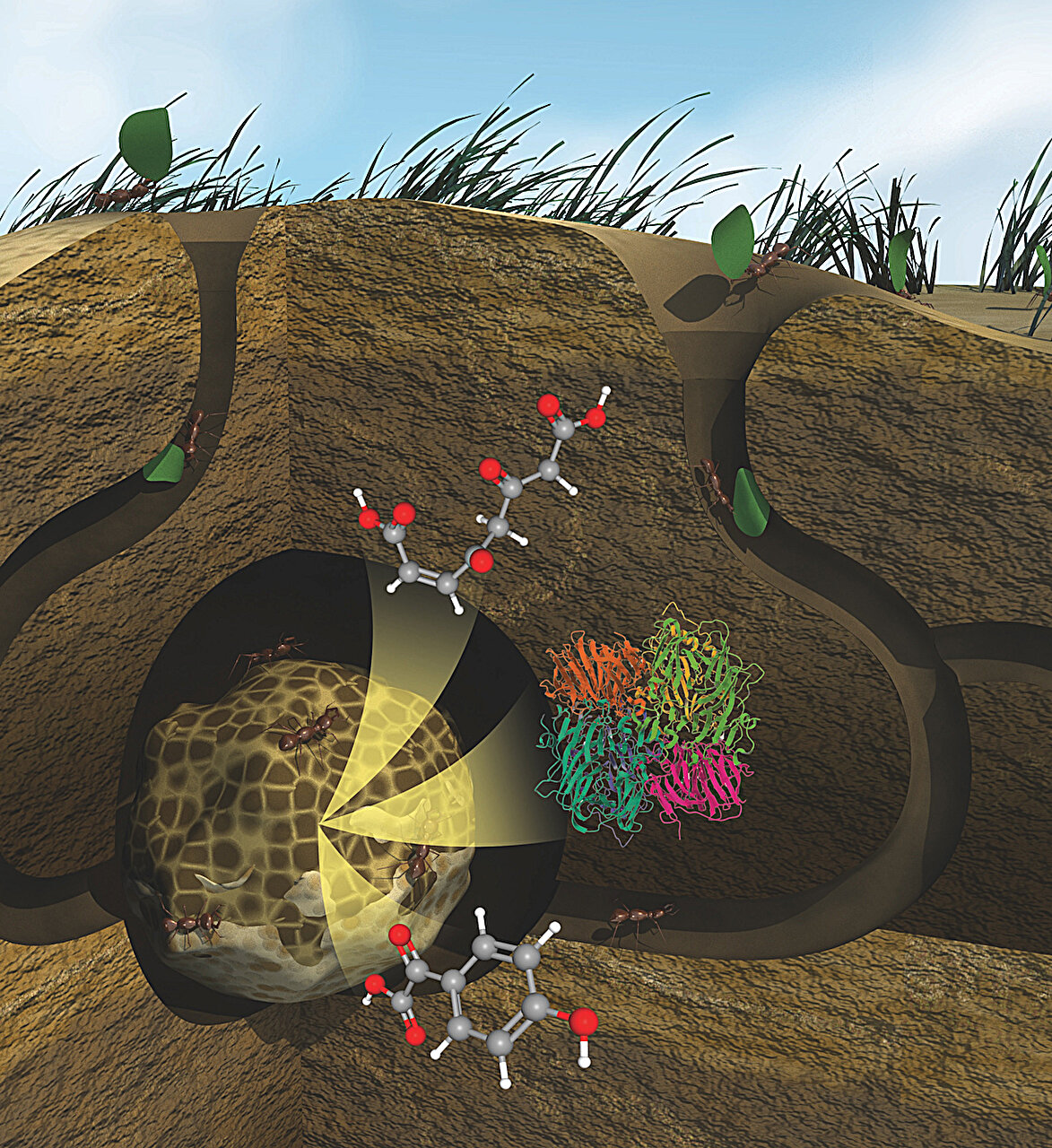

Trump's Trade Tactics: Cooking Oil and Soybean Disputes Highlight US-China Tensions

Amid escalating US-China tensions, President Trump is considering banning Chinese cooking oil imports, particularly used cooking oil (UCO), as part of broader trade retaliations linked to China's refusal to buy US soybeans. While such a ban would likely be symbolic due to the relatively small economic impact, it highlights ongoing disputes over biofuel feedstocks, domestic production challenges, and trade strategies, with implications for both US and Chinese markets.