Upcoming Changes to SNAP Benefits and Eligibility Rules

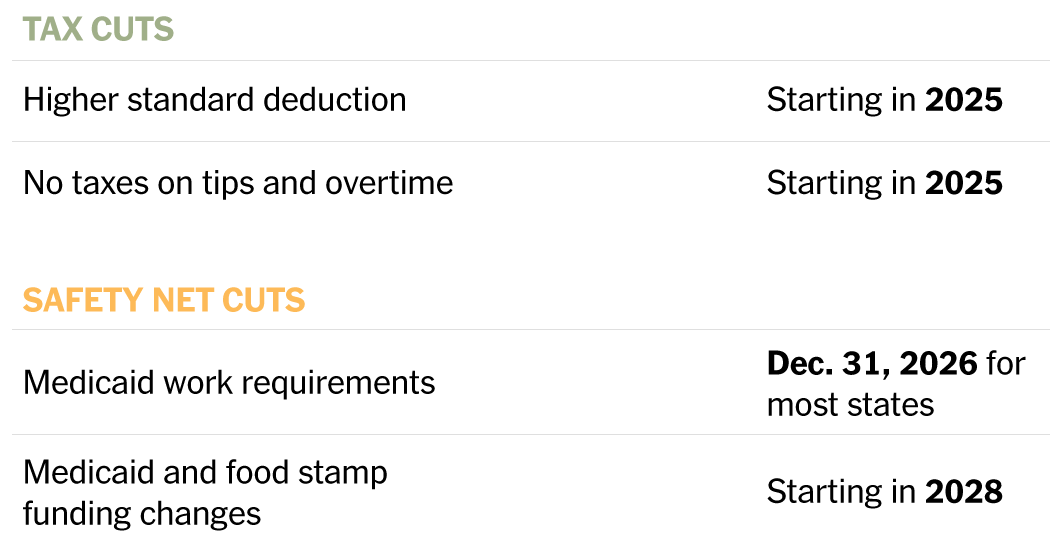

The USDA, led by Agriculture Secretary Brooke Rollins, plans significant reforms to the SNAP program, citing alleged fraud and misuse, amid ongoing debates over benefit eligibility and recent deep cuts. Critics argue the claims of widespread fraud are overstated and that the proposed changes could harm vulnerable populations, with some uncertainty about the specifics of the new policies and data supporting the claims. The administration is also considering narrowing eligibility rules, which could result in millions losing benefits.