Gold hits fresh peak as stocks rise and the dollar slides

U.S. stocks gained as gold reached a new record and the dollar weakened, signaling stronger appetite for risk assets.

All articles tagged with #us markets

U.S. stocks gained as gold reached a new record and the dollar weakened, signaling stronger appetite for risk assets.

U.S. stocks closed higher with the Dow and S&P 500 pushing to records while gold jumped, as Trump escalated his criticism of the Fed and Chair Powell, boosting policy uncertainty. Notable movers included Alibaba, Beam Therapeutics, and Duolingo.

U.S. stock futures are slightly down as traders await the final trading day of 2025, amid ongoing economic and market uncertainties.

Markets experienced a mixed start to the week with gains driven by trade optimism and hopes for ending the US government shutdown, while concerns remain over corporate earnings, regional bank jitters, and global supply chain dependencies, especially related to China and critical minerals.

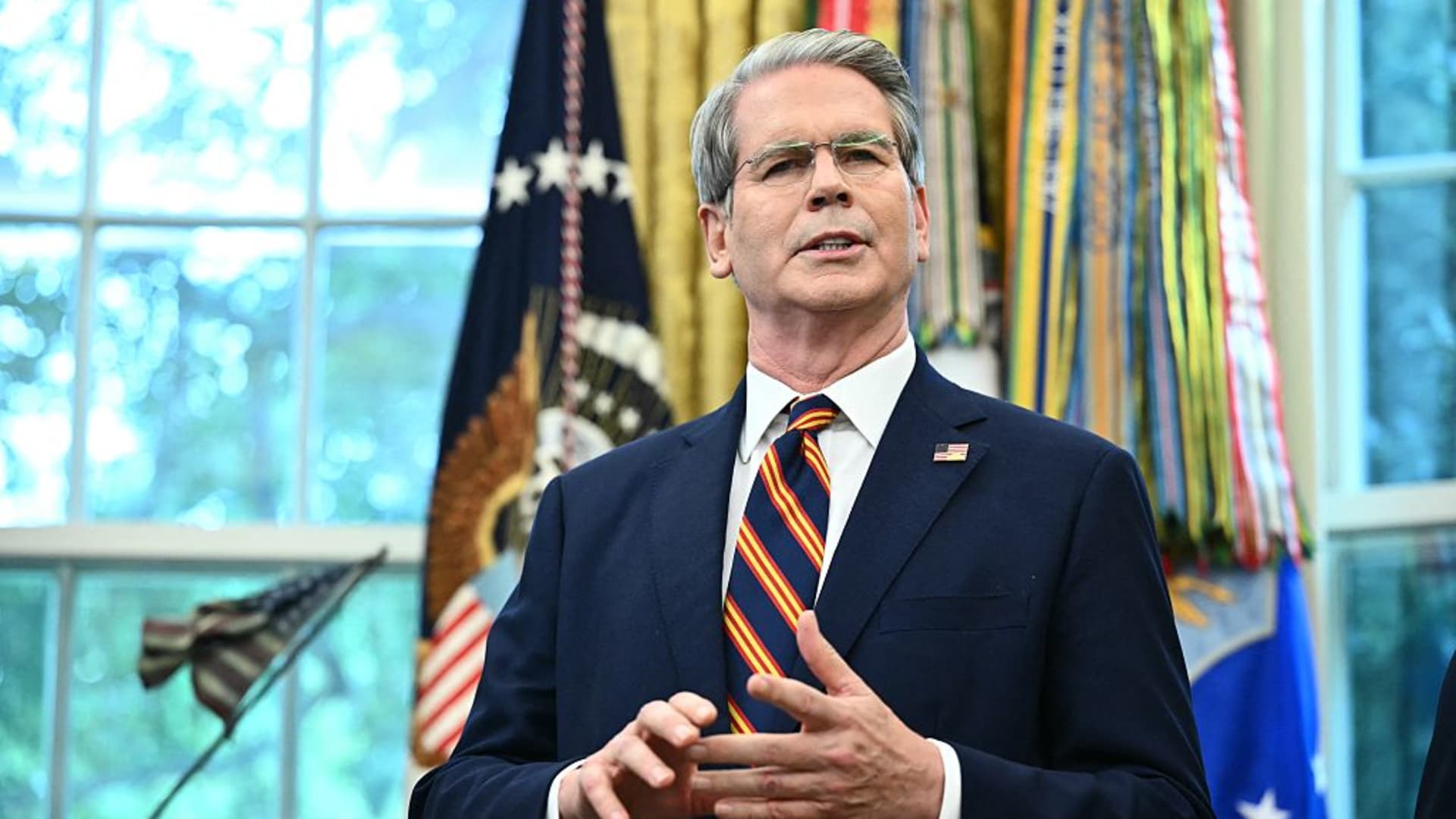

U.S. Treasury Secretary Scott Bessent supports President Trump's proposal to replace quarterly company reports with semiannual reports, arguing it would benefit investors by reducing compliance costs and aligning the U.S. with international standards, potentially making the U.S. more attractive for foreign companies, despite concerns about transparency and investor protection.

Investors anticipate a Fed rate cut this week, but experts warn it could have unintended negative effects, such as rising long-term yields and reaccelerating inflation, similar to the 2007 scenario where rate cuts failed to stimulate the economy and instead fueled inflation, potentially harming the stock market and economic growth.

Tether, a major player in the cryptocurrency space, is planning to launch a new stablecoin aimed at the US markets, signaling ongoing developments in digital currencies and their regulatory landscape.

Global markets are preparing for a busy three-day period of economic reports, policy decisions, and corporate earnings, with US trade tensions easing and investors focusing on interest rate policies and earnings from tech giants like Microsoft and Meta, amid a cautiously optimistic outlook for the global economy.

Wall Street is preparing for a critical three-day period that could significantly impact US markets, with investors closely watching upcoming events and data that may influence market direction.

The article examines whether American exceptionalism, characterized by the US's dominant financial markets, stable institutions, and economic resilience, remains valid amid political and economic challenges such as trade protectionism, rising federal debt, and global shifts in investment. Despite recent uncertainties, US assets continue to attract significant foreign investment, supported by the dollar's status and the strength of US companies, especially in technology. However, concerns about long-term sustainability and the potential for diversification are prompting some investors to reconsider their reliance on US assets, exploring alternatives like Europe and China.

U.S. stocks rose amid reports that Iran seeks a ceasefire with Israel, despite Israeli opposition to one, as geopolitical tensions in the Middle East persist. The conflict has prompted increased defense spending, including AI contracts for the U.S. Defense Department, and influenced market reactions, with gold emerging as a safe haven amid ongoing instability.

Major investors are moving away from US markets, indicating a shift in investment trends, as reported by FT, which offers exclusive financial insights.

Ruchir Sharma, chair of Rockefeller International, warns of a massive financial bubble as U.S. markets dominate global investment, drawing unprecedented foreign capital and overshadowing other economies. U.S. companies now make up 70% of the leading global stock index, despite the U.S. economy only accounting for 27% of global GDP. This dominance is causing a 'sucking' effect, pulling money away from other markets and potentially destabilizing them. Sharma's concerns echo those of other experts, highlighting the risks of overvaluation and overhype in U.S. markets.

U.S. inflation rose slightly in October, with core inflation at 2.8% annually, but this did not alarm investors. The S&P 500 ended its seven-day rally, and the Nasdaq dropped 0.6% as traders took profits from Big Tech stocks. Despite the market dip, investors remain optimistic, with many betting on a Federal Reserve rate cut in December. Bitcoin, meanwhile, rebounded by 5.4%, moving contrary to U.S. stock trends. Overall, the market remains stable, with most S&P stocks above their 200-day moving average, as investors prepare for Thanksgiving.

U.S. markets are on edge ahead of Friday's PCE inflation update, with mixed economic signals and political news, including Trump's conviction, adding to the uncertainty. The Federal Reserve remains cautious about easing interest rates despite some disinflationary signs. Global markets are also focused on U.S. inflation, with additional attention on euro zone inflation and China's economic struggles.