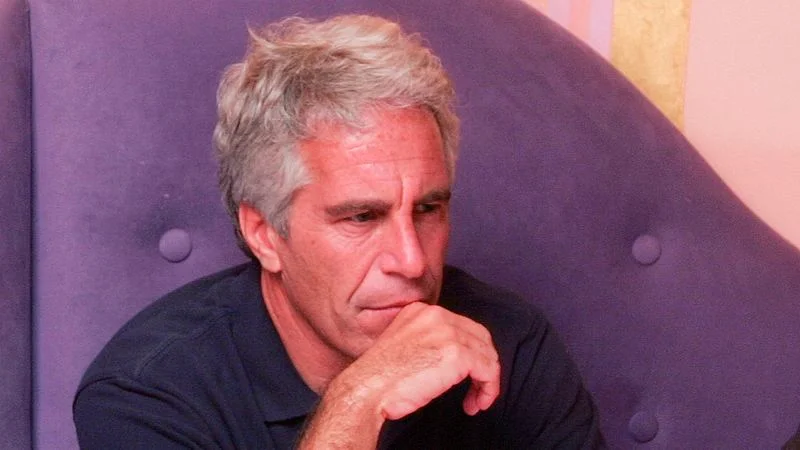

Epstein Files Spark a New Wave of Corporate Departures

A fresh wave of executives is resigning as millions of Epstein files illuminate closer ties between Epstein and prominent business leaders, prompting questions about judgment and ethics. Hyatt's Tom Pritzker and Goldman Sachs’ Kathy Ruemmler are among the latest to step down, with other high-profile figures like Casey Wasserman and Peter Mandelson under scrutiny. Analysts say markets react faster than political arenas, boards are tightening governance, and more fallout is expected as the Epstein documents continue to surface.