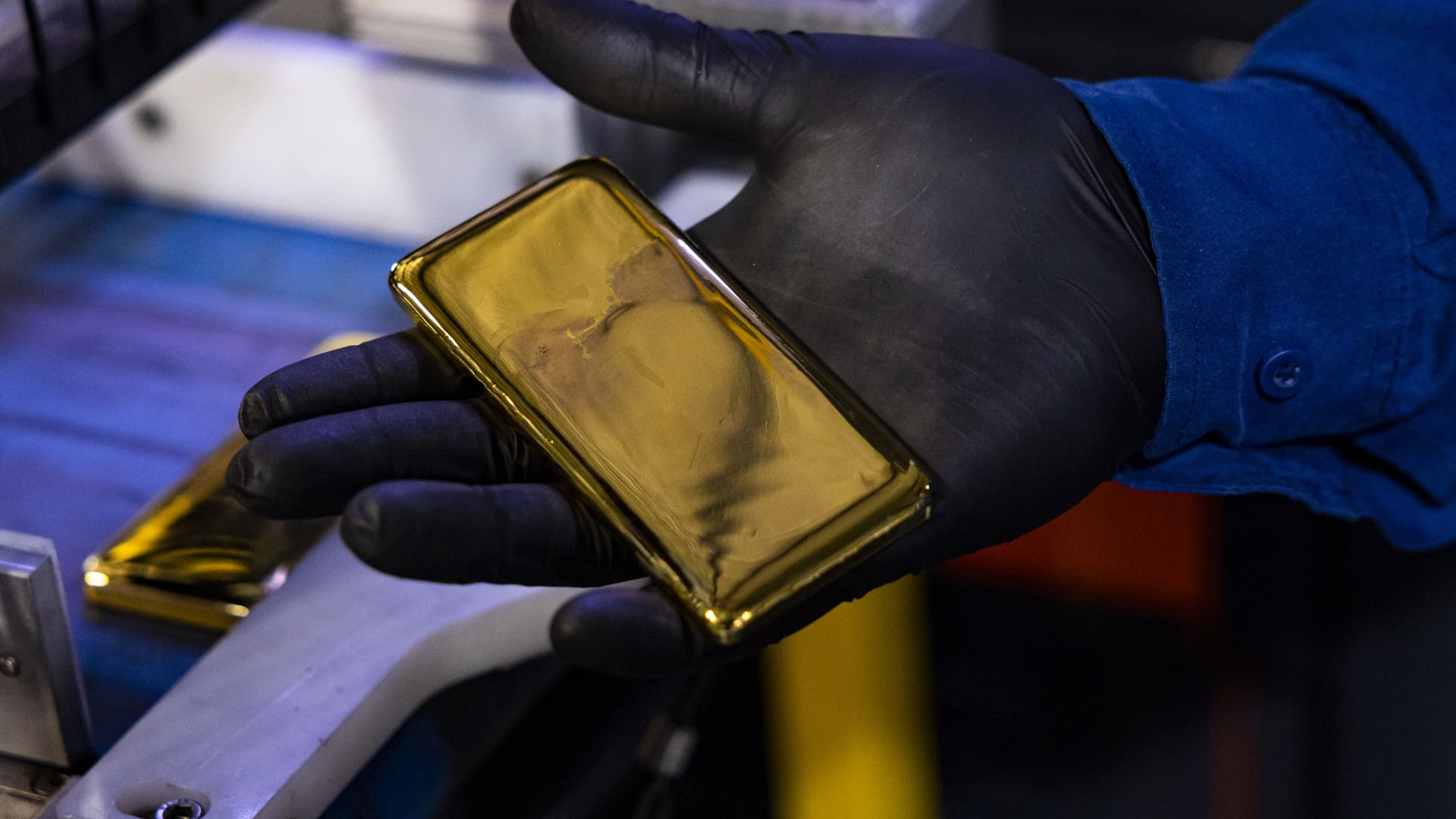

Gold Surges Above $5,000 as Dollar Weakens and U.S. Data Loom

Gold futures climbed back above $5,000/oz, rising about 2% to roughly $5,051, as a softer dollar rekindles safe-haven demand; silver also gained, and traders await upcoming U.S. jobs and inflation data to gauge the path of Fed rate cuts, with some analysts seeing room for gold to retest record highs.