US Debt Dynamics: Who Holds the Debt as the Fed Sheds Securities?

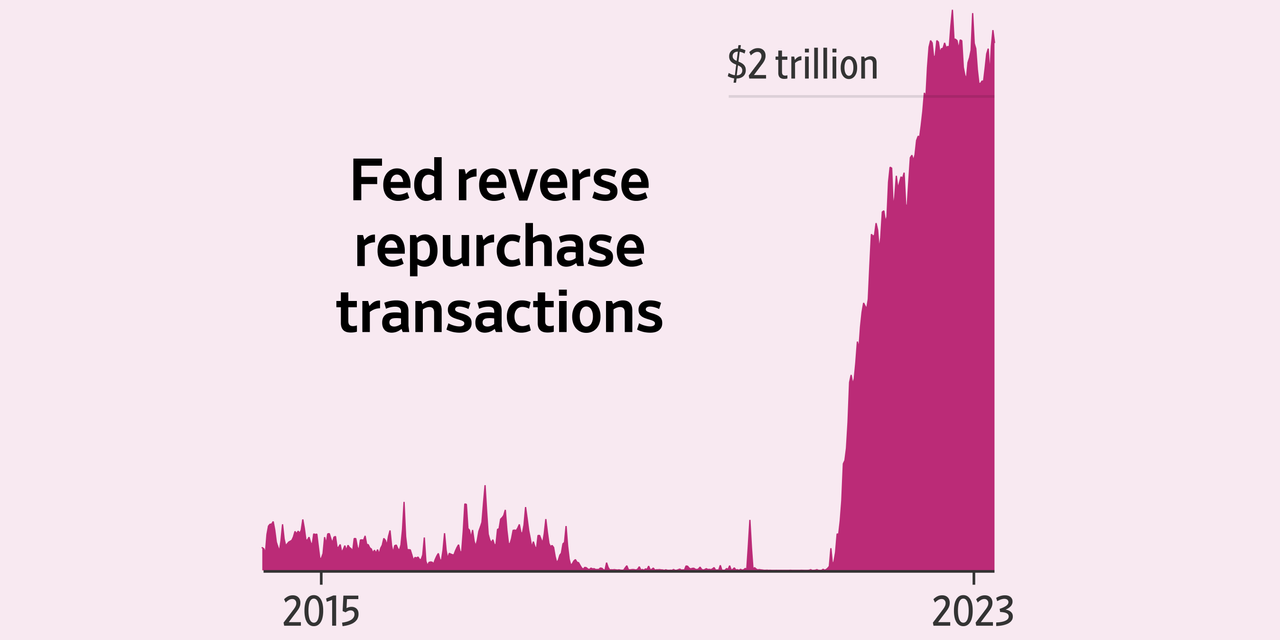

The article analyzes who holds the US government debt at the end of Q1, revealing that foreign entities, especially European financial centers and Canada, are significant buyers, while US entities like mutual funds, the Fed, and households also hold substantial portions. Despite the Fed shedding Treasuries, foreign and US holders continue to buy, with market values fluctuating due to interest rate changes, highlighting an uncertain debt landscape.