Money-Market Funds: A Safe Haven Amid Economic Uncertainty

TL;DR Summary

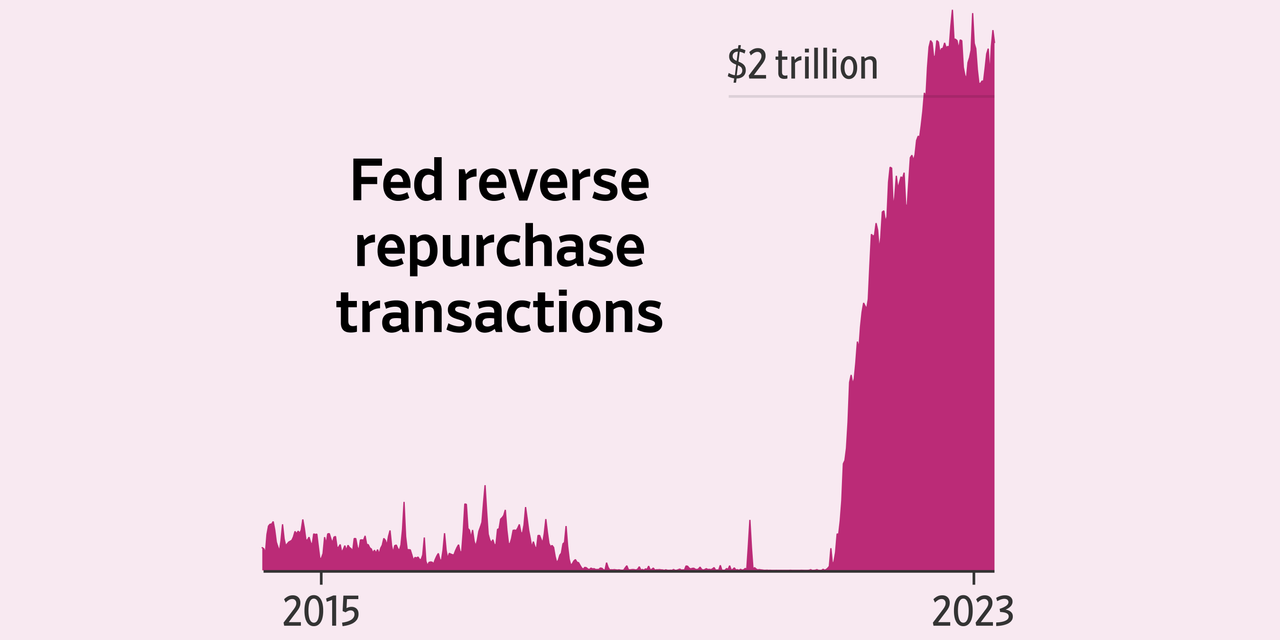

Deposit outflows from banks to money-market funds are putting pressure on the Federal Reserve's overnight reverse repurchase facility, which borrows from money funds and other firms in exchange for securities such as Treasurys and then returns the money the next day. The facility offers interest on firms' cash balances, but some analysts say the flows add to bank-system stress. Money-market fund assets are increasing at a record clip, with much of that cash making its way to the Fed's program.

Topics:business#bank-deposits#federal-reserve#finance#money-market-funds#reverse-repo#treasury-securities

- Deposit Outflows Shine Light on Fed Program That Pays Money-Market Funds The Wall Street Journal

- People have moved billions from bank accounts to money market funds. What are those? Marketplace

- 'It's like cash under the mattress.' But some see systemic risks as money-market funds park trillions with Fed MarketWatch

- Barclays Sees $1.5T More Flowing Into Safest Money-Market Mutual Funds Bloomberg

- Rush to Money-Market Funds Could Be Search for Safety, Rather than Yield The Wall Street Journal

- View Full Coverage on Google News

Reading Insights

Total Reads

0

Unique Readers

7

Time Saved

0 min

vs 1 min read

Condensed

47%

152 → 80 words

Want the full story? Read the original article

Read on The Wall Street Journal