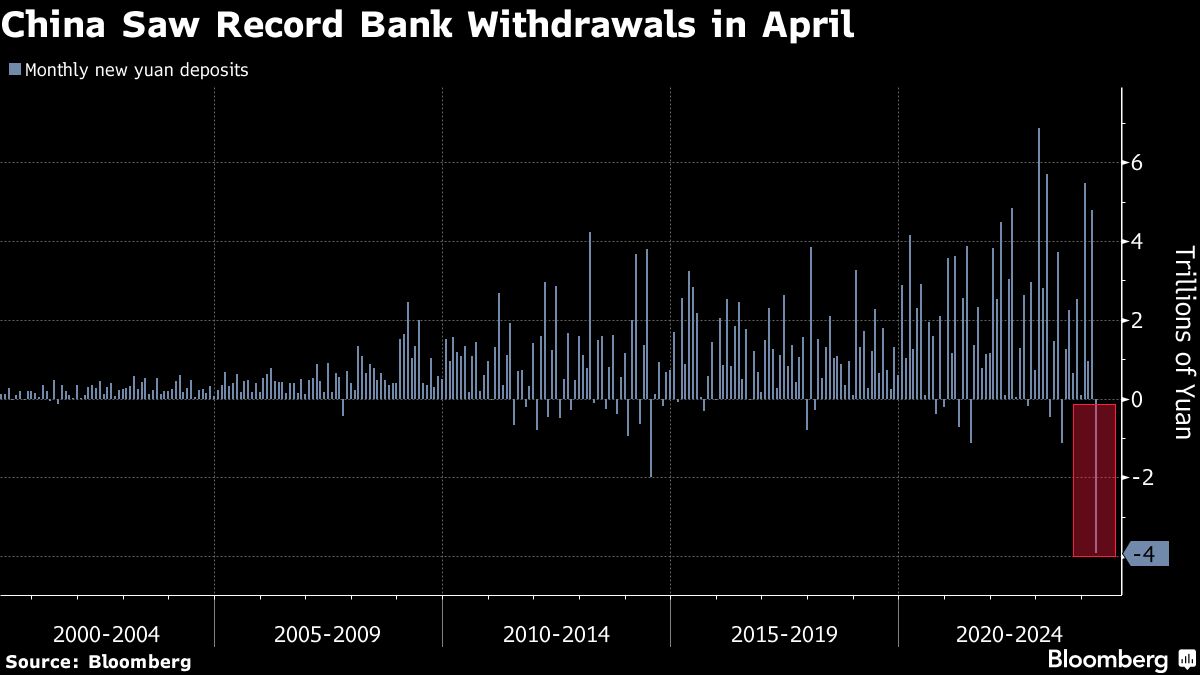

China's $538 Billion Capital Exodus Fuels Bond Rally, Pressures Yuan

China's economic policies have led to a significant shift of 3.9 trillion yuan from bank deposits into bonds and wealth management products in April, as investors seek higher returns. This movement is driven by reduced deposit rates and efforts to boost risk appetite, though it has not yet spurred consumer spending or stock investments significantly. The trend reflects low economic confidence, with funds favoring fixed-income assets and dividend stocks over riskier investments.