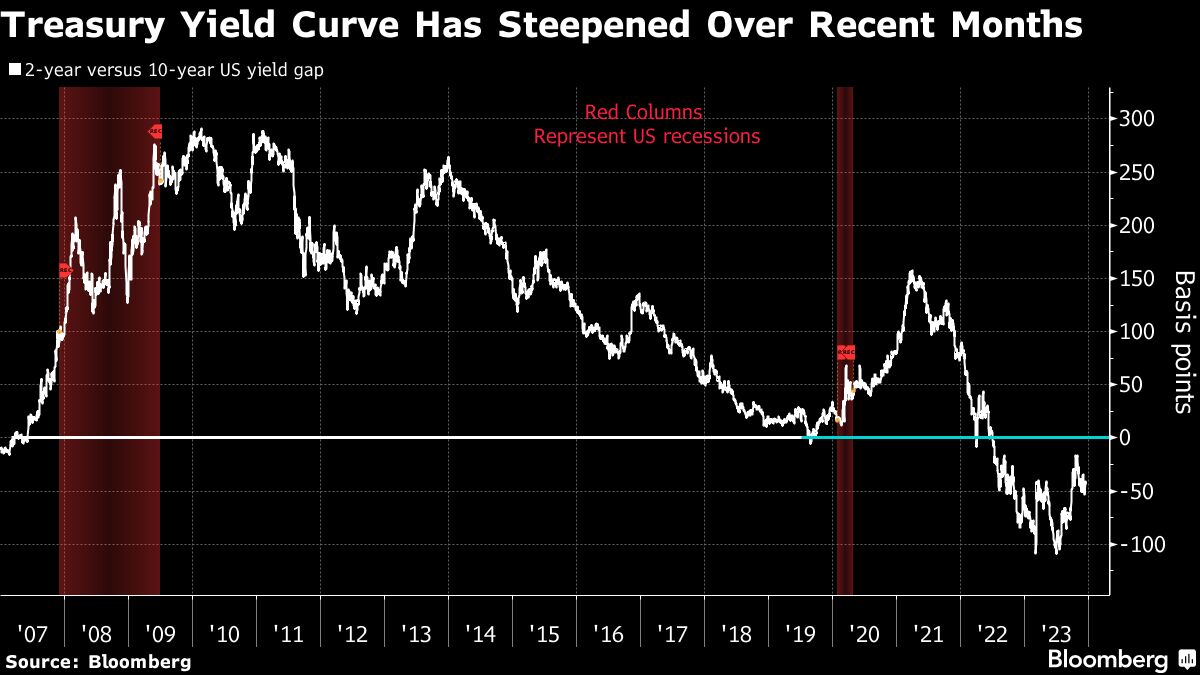

Bond Markets React Positively to Fed Rate Cut Expectations

Bond fund managers on Wall Street are focusing on middle-maturity Treasuries, especially around 5 years, as they believe this strategy will perform well regardless of the Federal Reserve's uncertain path of interest rate cuts, which are influenced by mixed economic signals and inflation concerns.