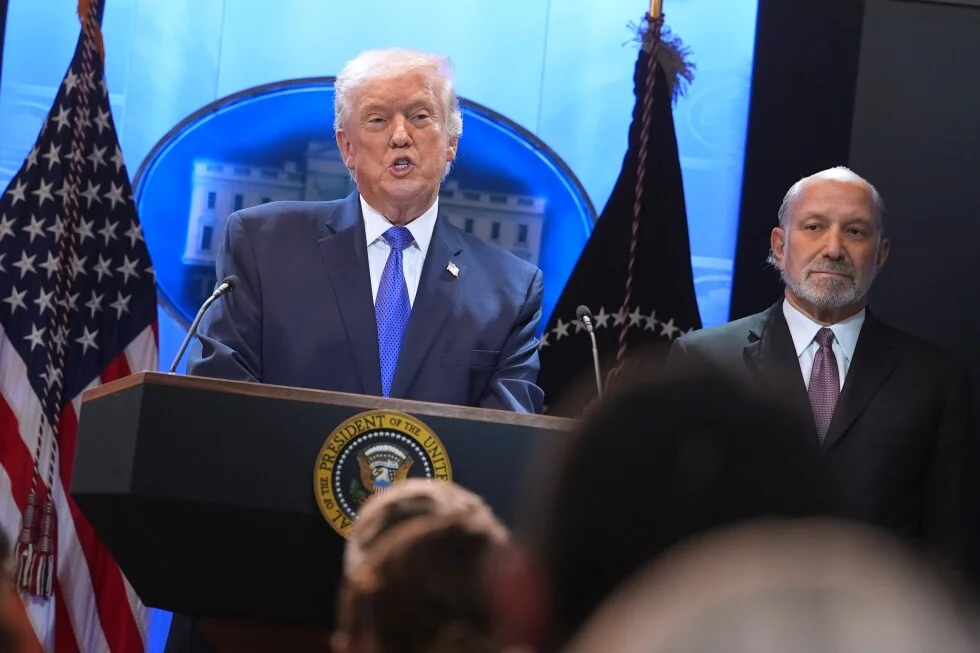

White House weighs citizenship proof for bank accounts

The Trump administration is reportedly weighing an executive-order-style move to require banks to collect citizenship documentation from customers, potentially barring some noncitizens from opening or maintaining accounts; however, experts say unilateral action is unlikely and any policy would likely require Congress or APA rulemaking, with broader implications as part of a series of moves restricting financial access for noncitizens.