Jim Grant Warns Warren Buffett's Caution on US Stocks

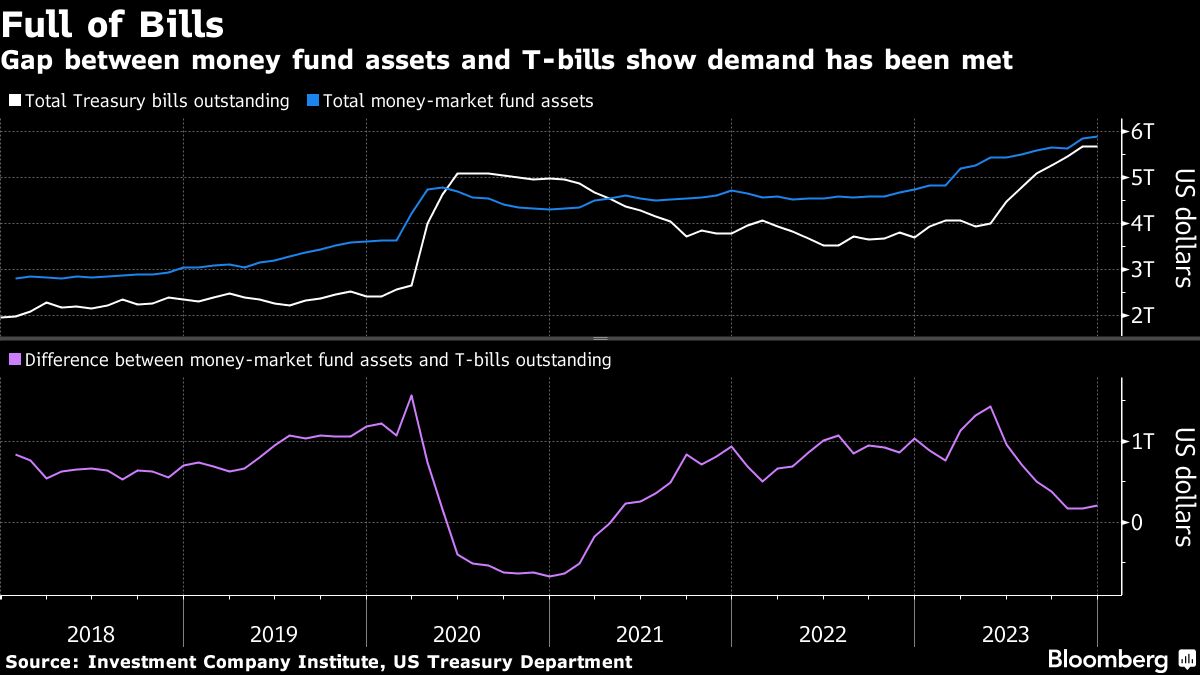

Jim Grant warns that the US stock market may be overheated, highlighting Warren Buffett's shift towards safer assets like Treasury bills, with Berkshire Hathaway holding over $234 billion in T-bills, suggesting caution for investors amid a bullish market. Grant emphasizes the importance of considering safer investment options such as high-yield savings accounts and platforms like Public for uninvested funds.