"Anticipating Mid-2024 Fed Rate Cuts: Strategies for Savers and Market Predictions"

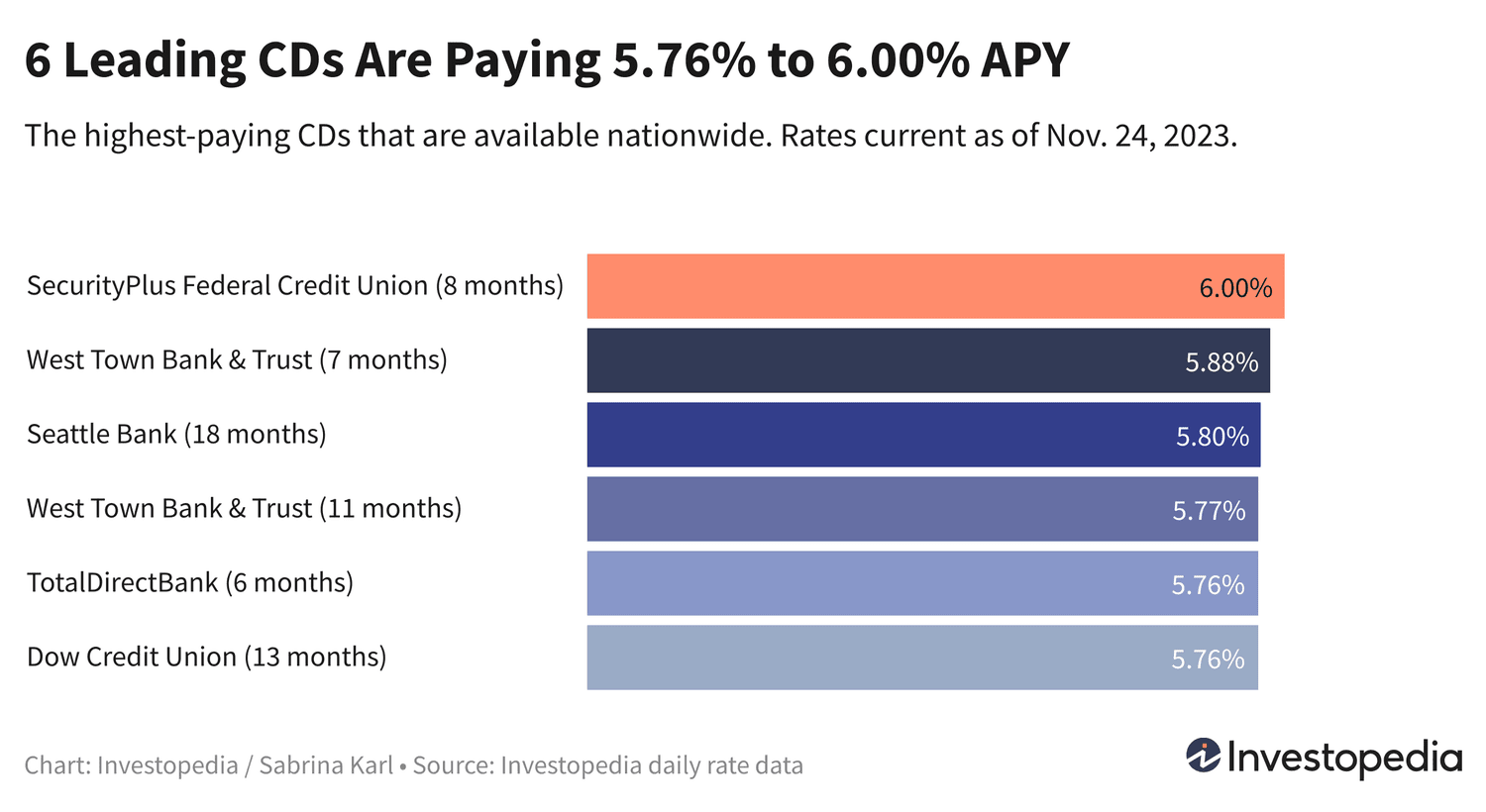

As the Federal Reserve anticipates interest rate cuts in 2024, financial experts recommend four savings options for investors seeking short-term places to park their cash. These include certificates of deposit (CDs) to lock in current higher yields, penalty-free CDs for flexibility without sacrificing interest, Treasury bills (T-bills) for a tax-advantaged and government-backed investment, and money market mutual funds for ease of access and competitive rates. However, yields on these products are expected to decrease following the Fed's rate cuts, so investors should consider acting soon to secure better returns.