"US Treasury's Strategic Borrowing Plans: Impact on Investors and the Economy"

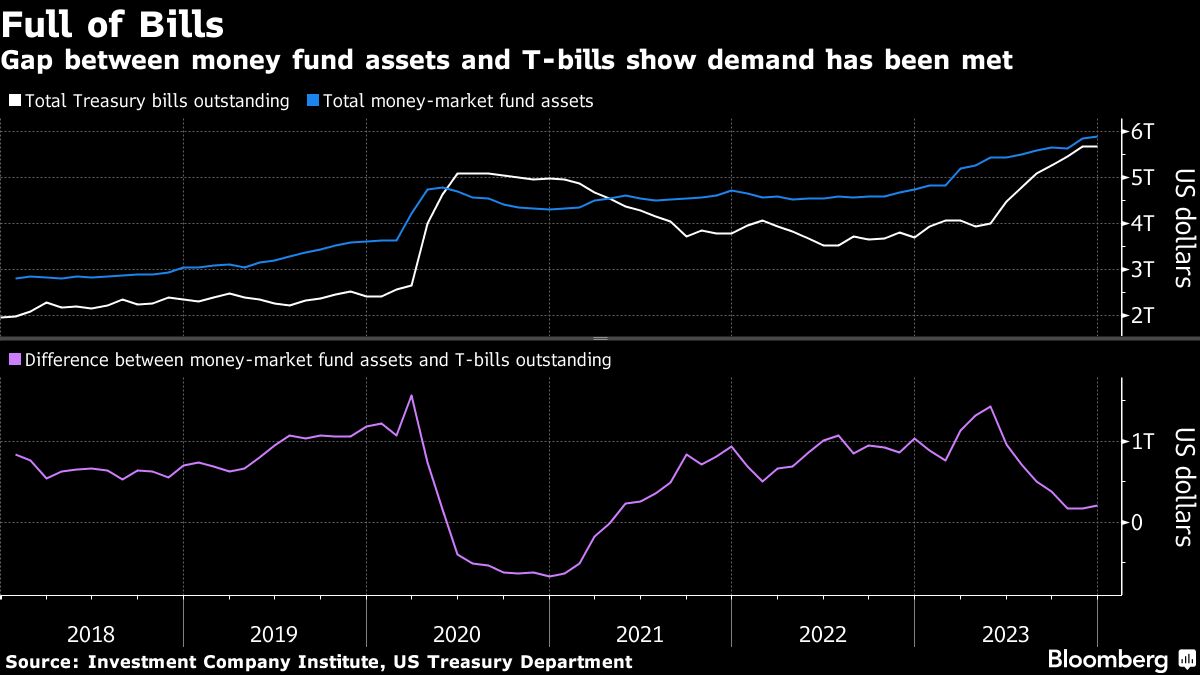

The US Treasury is set to reduce the supply of Treasury bills, coinciding with the Federal Reserve's plans to taper its balance sheet unwind, which is seen as favorable for investors who have been heavily investing in the debt. The reduction in bill sales is expected to exceed $250 billion between April and June, reflecting a decrease in appetite for short-dated government debt. This move comes as the gap between money-market fund assets and total bills outstanding narrows, and the usage of a key Fed facility declines. The Treasury's efforts to term out the debt through larger coupon auctions are viewed as prudent in this context, as the market may soon reach a turning point in absorbing bill supply.

- US Is Shrinking T-Bill Supply at Just the Right Time for Investors Yahoo Finance

- What Investors Need to Know About the U.S. Government's Borrowing Plans The Wall Street Journal

- US Economy Today: Borrowers Are Falling Behind on Their Bills Investopedia

- Treasury Department Trying Very Hard to Push Down Yields with its Quarterly Refunding Announcements. So We Take a Look WOLF STREET

- US Treasury to borrow $760 billion in Q1, lower than October forecast Reuters.com

Reading Insights

0

5

3 min

vs 4 min read

81%

625 → 119 words

Want the full story? Read the original article

Read on Yahoo Finance