Biden's Recent Successes Garner Positive Reactions and Praise.

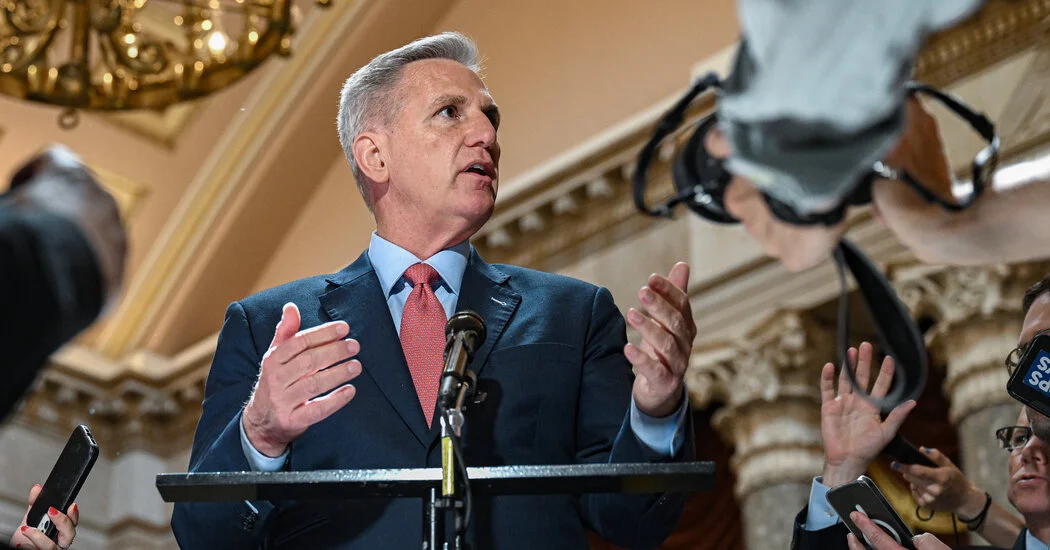

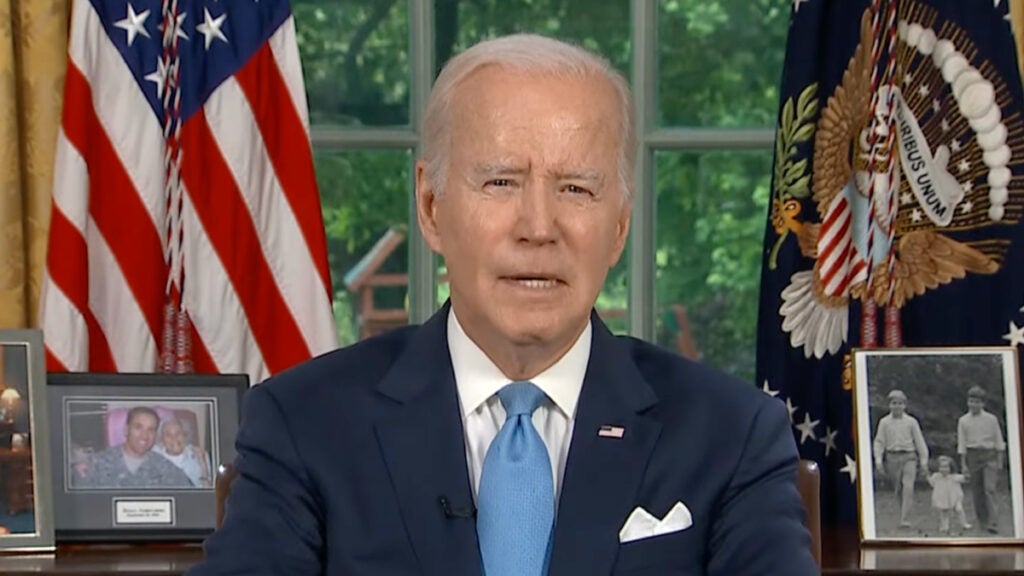

Reactions to President Joe Biden's Oval Office speech celebrating the bipartisan agreement to prevent a government default are divided on Twitter. Some praised Biden's leadership and competency, while others made low blows about his age. The agreement raises the debt limit until 2025 and gives legislators budget targets for the next two years. Critics on both sides of the aisle say lawmakers negotiated away too much.