"Tech-Led Surge: Stocks Rise Ahead of Key Inflation Data"

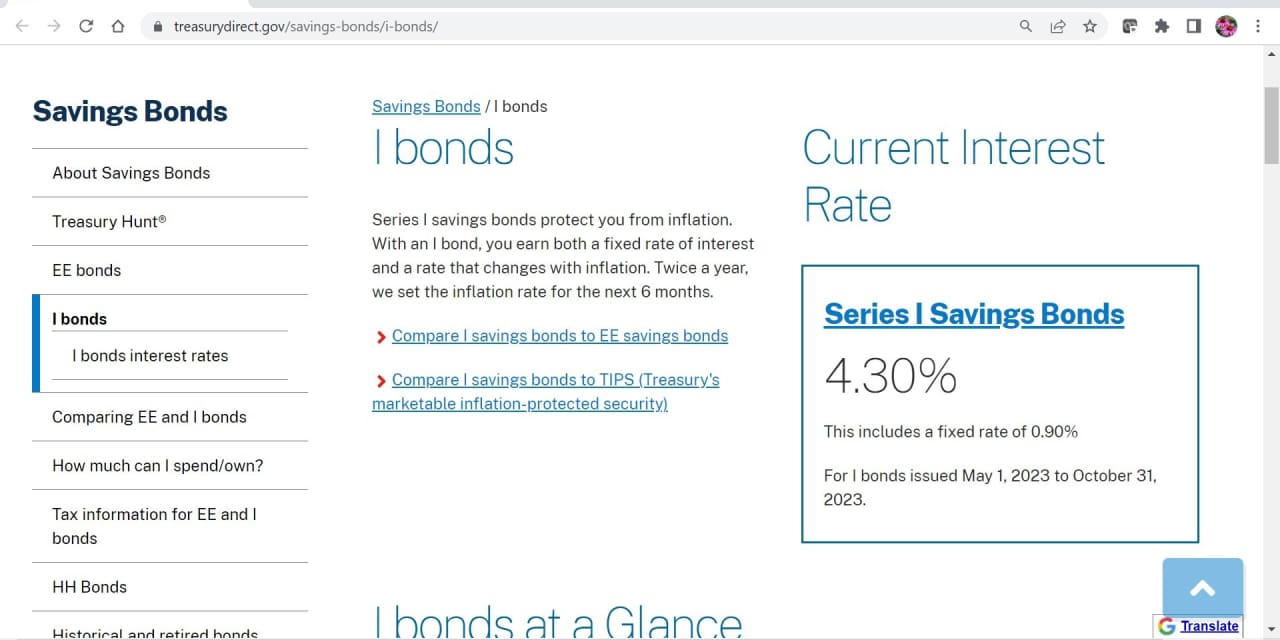

As inflation rates decrease, I bonds purchased during high inflation periods are now paying significantly lower rates, prompting financial experts to advise selling and reinvesting. With the current I bond rate at 5.27%, consisting of a fixed rate of 1.30% and a variable rate of 3.97%, individuals are encouraged to consider alternative investment options such as money markets, laddered CDs, and corporate bond bullets.