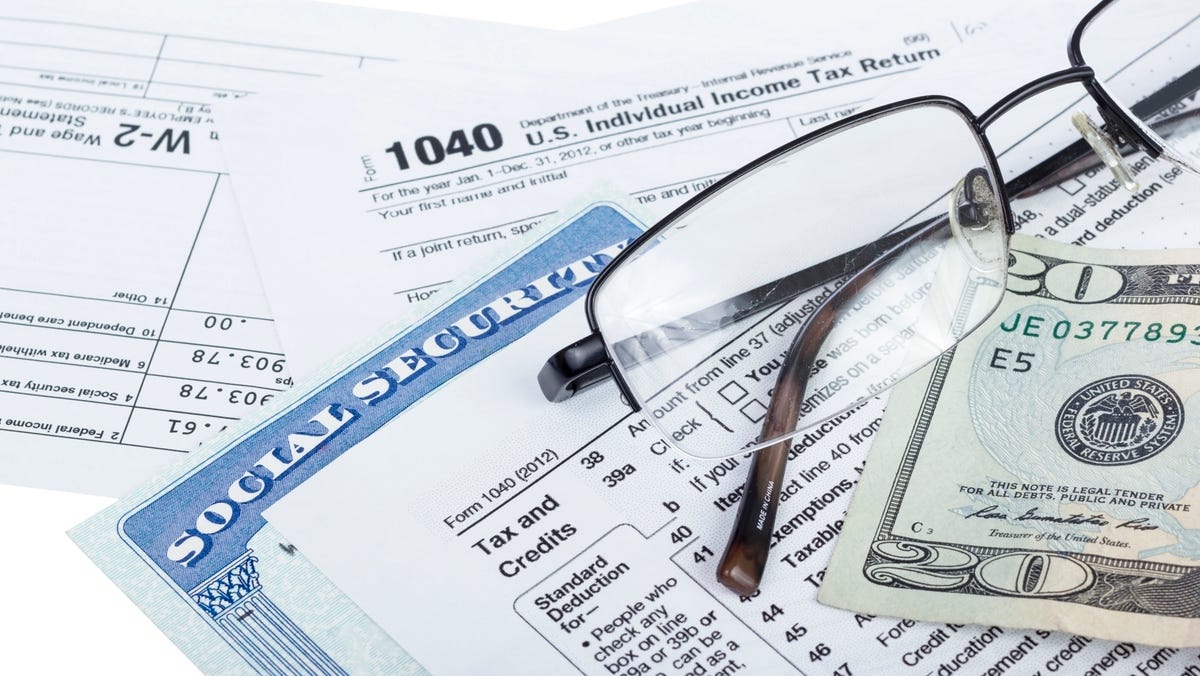

Trump’s tax-refund gamble may yield a short-lived pocketbook boost

President Trump bets bigger spring tax refunds—bolstered by the GOP tax cuts—that they’ll boost his political fortunes, but economists warn the relief could be short-lived as rising costs (housing, healthcare, energy) erode gains, with many filers not receiving large refunds and one-off payments unlikely to shift long-term sentiment.