"IRS Launches Free 'Direct File' Tax Service in 12 States for 2024 Tax Returns"

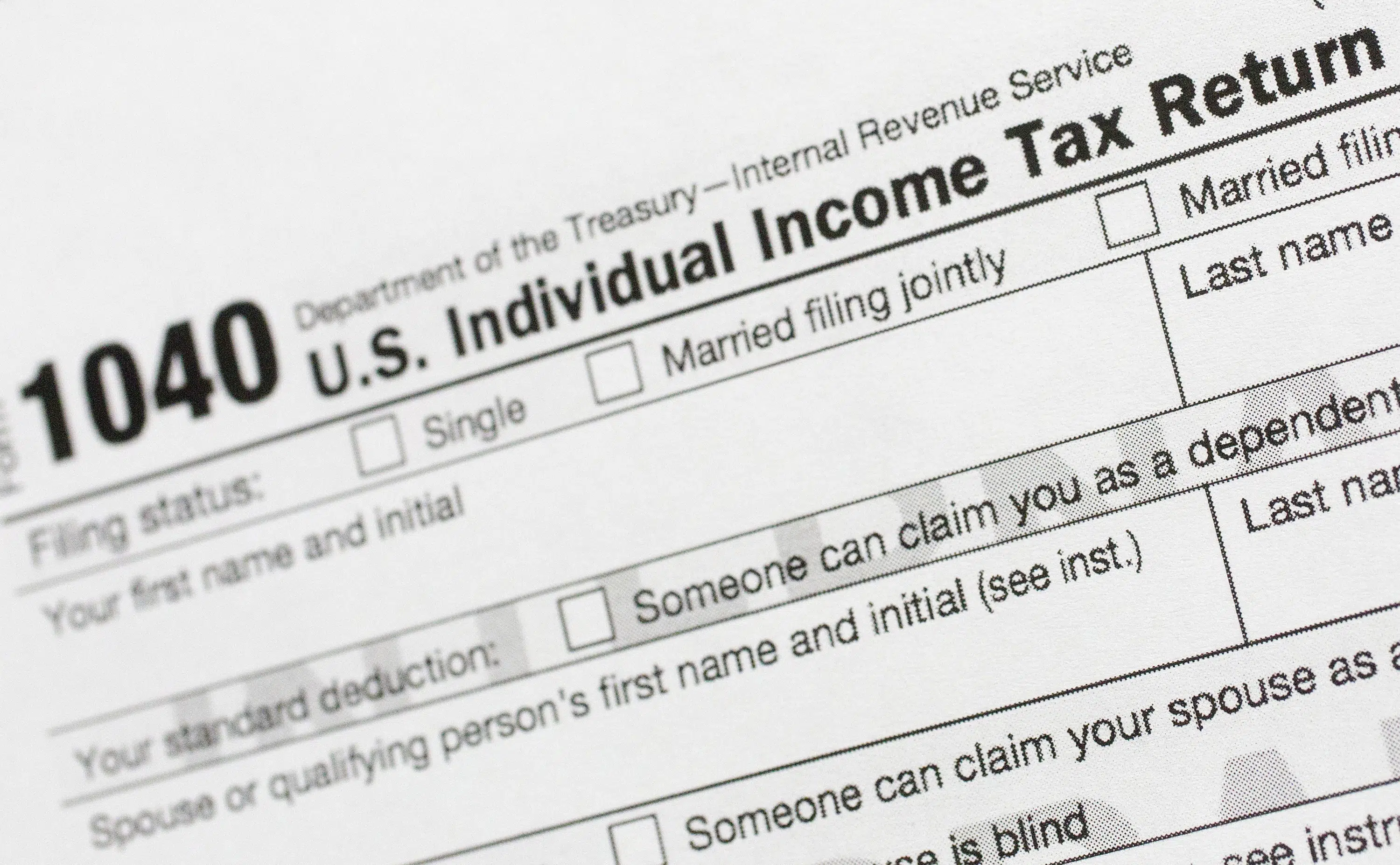

Americans have multiple options to file their taxes for free, including the Free File program for those with adjusted gross incomes under $79,000, and the new Direct File pilot program for simple tax returns. Other free options include Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) for those with specific income levels or age requirements, and MilTax for military members and their families. These programs offer in-person or online tax preparation services, with eligibility criteria and specific filing instructions.