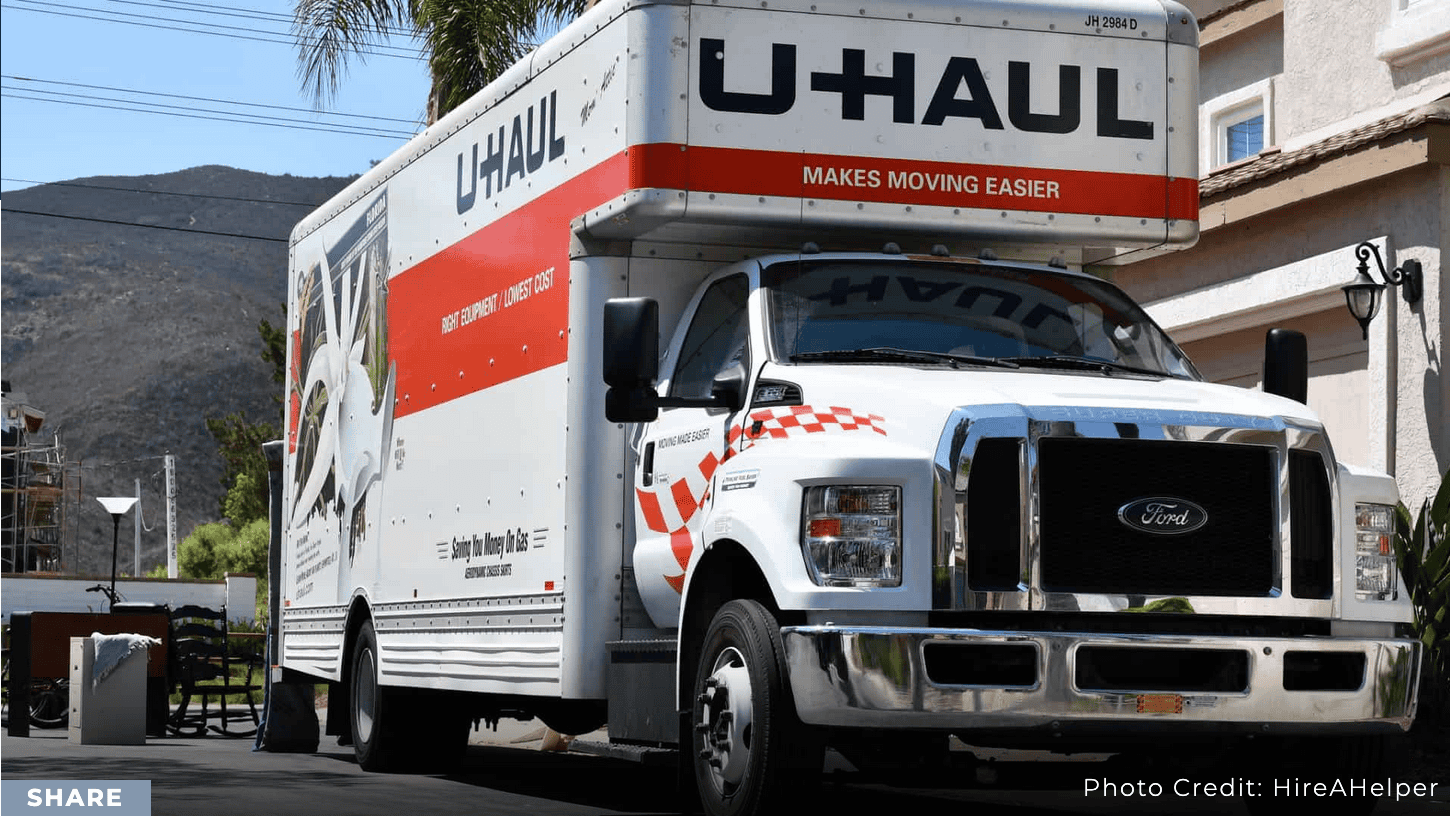

Americans Flee High-Tax States for Growth Cities in 2025

The U-Haul Growth Index reveals Americans are moving away from high-tax states like California and New York towards low-tax states such as Texas and Florida, with a strong correlation between lower personal income tax rates and higher migration. The index also highlights that most top-performing states have Right-to-Work laws, while the bottom states do not, emphasizing the impact of tax and labor policies on migration patterns.