Experts Warn Americans About Early Social Security Claims

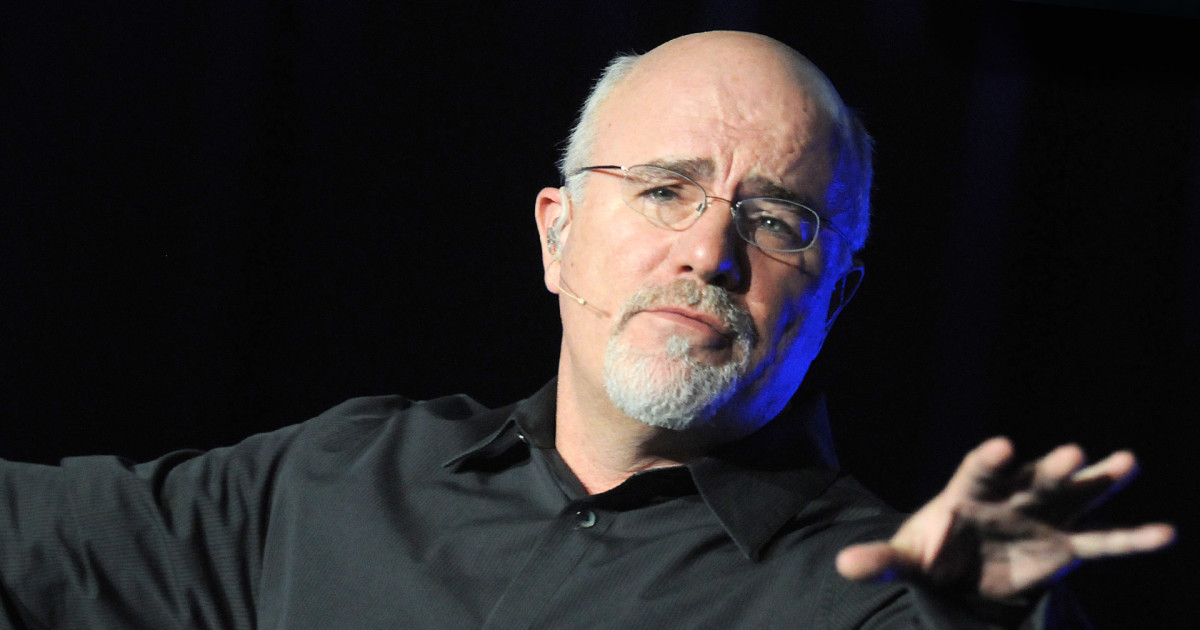

Dave Ramsey and AARP warn Americans about the implications of claiming Social Security early, highlighting how working while receiving benefits can reduce monthly payments due to income limits, but benefits are restored at full retirement age; Ramsey suggests early claiming may be suitable for those with health issues or who don't rely on benefits for daily expenses, emphasizing Social Security as a supplement, not a complete retirement plan.