PCAOB to Implement Budget Cuts and Pay Reductions in 2026

The Trump administration plans to reduce the pay of US audit regulators, impacting oversight agencies and potentially affecting regulatory standards.

All articles tagged with #regulatory agencies

The Trump administration plans to reduce the pay of US audit regulators, impacting oversight agencies and potentially affecting regulatory standards.

FCC Chairman Brendan Carr stated that the agency is not independent, a sentiment reflected by the removal of the word 'independent' from its mission statement, highlighting concerns about the agency's autonomy and its alignment with the current administration's influence.

Federal financial regulatory agencies have announced the immediate withdrawal of their Principles for Climate-Related Financial Risk Management for large financial institutions, stating that existing safety and soundness standards sufficiently address financial risks, including emerging ones.

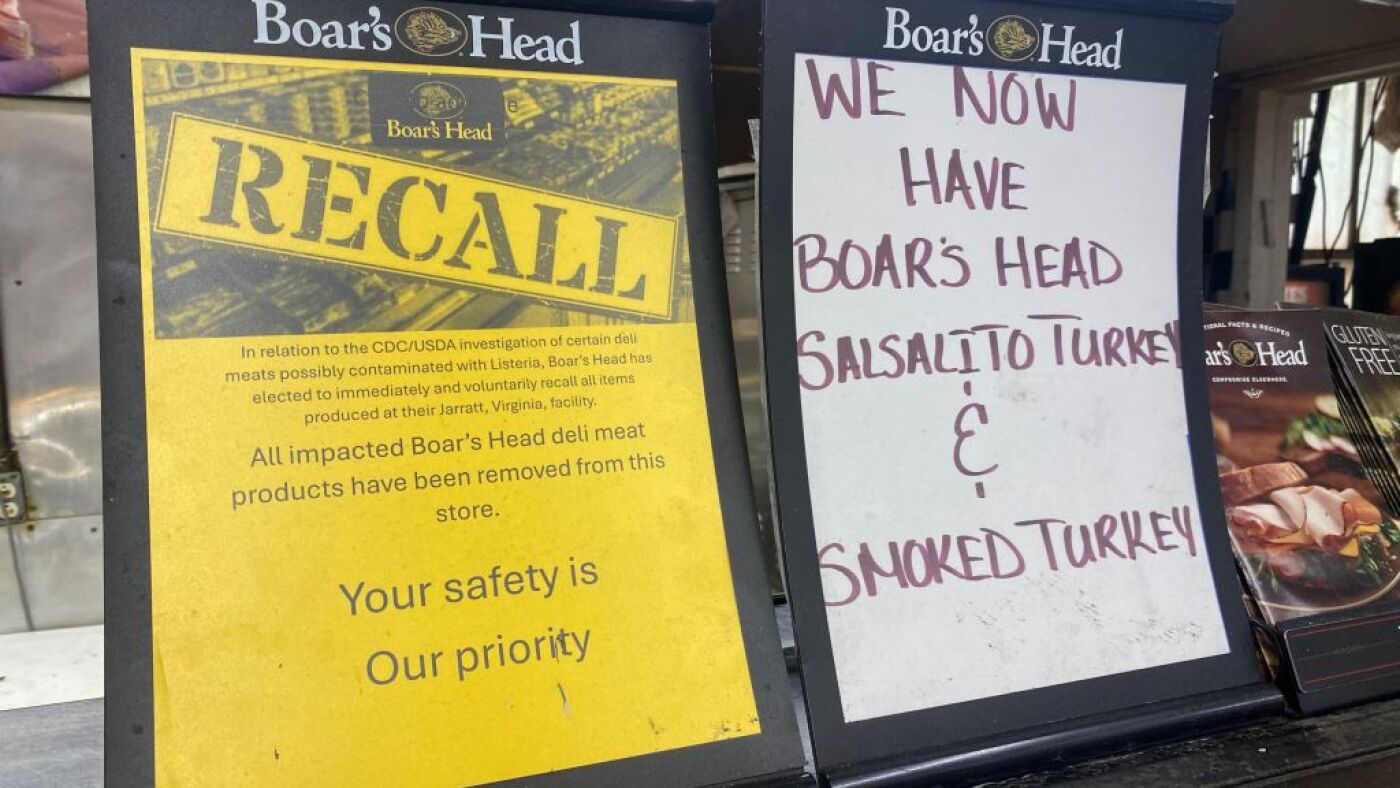

Experts express concern that recent federal budget cuts and staff retirements have compromised the U.S. food safety system, risking increased outbreaks of foodborne illnesses like listeria, due to reduced inspections and delayed testing.

Elon Musk, as co-leader of the Department of Government Efficiency, suggested abolishing the Consumer Financial Protection Bureau (CFPB) under Donald Trump's administration, claiming it is duplicative of other banking regulators. This proposal aligns with the conservative agenda Project 2025, which also calls for the CFPB's elimination. The CFPB, established in 2010, aims to protect consumers from unfair financial practices and operates independently of the executive branch.

Elon Musk has called for the elimination of the Consumer Financial Protection Bureau (CFPB), a federal agency established to protect consumers from predatory financial practices. Musk, who is set to lead a new advisory agency under Donald Trump's administration, argues that the CFPB is an example of redundant regulatory bodies in Washington. This move aligns with broader plans to reduce government spending and regulations, as outlined by Musk and fellow entrepreneur Vivek Ramaswamy. Critics warn that such cuts could face significant legislative challenges.

Elon Musk has called for the elimination of the Consumer Financial Protection Bureau (CFPB), labeling it as a redundant regulatory agency. This suggestion aligns with President-elect Donald Trump's plans to review government spending. Musk's comments were made on X, the social media platform he owns.

The SEC's climate disclosure rule, which would require publicly traded firms to disclose climate-related risks, has faced legal challenges and backlash due to concerns about increased compliance costs, potential business consolidation, and regulatory overreach. Critics argue that the rule may burden smaller companies, duplicate existing regulatory efforts, and exceed the SEC's statutory authority. There are calls for congressional intervention to prevent excessive regulatory burdens and ensure agencies operate within their intended scope.

A new report has revealed that there are at least 16,000 plastic chemicals, with over 4,200 considered highly hazardous to human health and the environment, yet only 980 of these have been regulated. The report emphasizes the urgent need for tighter regulation of plastics and their chemicals, as they pose a significant threat to human health at every stage of their lifecycle. The report also suggests grouping similar chemicals into classes for more effective regulation, as well as the need for detailed hazard information for the majority of these chemicals.

The World Health Organization and drug regulators are urging flu vaccine manufacturers to remove the B/Yamagata component from flu vaccines due to its apparent eradication during the Covid-19 pandemic. However, the process is complex and may take until the 2025-2026 Northern Hemisphere cycle to be implemented globally, with over 350 trivalent vaccine licenses needing updates and approvals from approximately 170 regulatory agencies. The International Federation of Pharmaceutical Manufacturers and Associations is advocating for a synchronized global shift, while some experts believe the transition can be made sooner in certain countries.

Federal bank regulatory agencies have issued final joint guidance to help banking organizations manage risks associated with third-party relationships, including relationships with financial technology companies. The guidance covers risk management practices for the stages in the life cycle of third-party relationships and includes illustrative examples to help community banks align their risk management practices with the nature and risk profile of their third-party relationships. The final guidance replaces each agency's existing general third-party guidance and promotes consistency in the agencies' supervisory approaches toward third-party risk management.

Disinfectant wipes containing quaternary ammonium compounds (QACs) are exposing people to dangerous chemicals that are linked to serious health problems, contribute to antimicrobial resistance, pollute the environment, and are not particularly effective against COVID-19. Recent research has linked QACs to infertility, birth defects, metabolic disruption, asthma, skin disorders, and other diseases. The chemicals are persistent and thought to be bioaccumulative, meaning they accumulate in human bodies and the environment. The paper calls on regulatory agencies to provide more clarity around the chemicals, including more research on quats’ health effects, better labeling, and elimination of non-essential uses.

Treasury Secretary Janet Yellen chaired a private meeting with top financial regulators from the Financial Stability Oversight Council amid renewed fears over the global banking system. Regulators have rushed to contain fallout after the implosion of Silicon Valley Bank and Signature Bank earlier in March, including protecting all deposits at the two institutions. However, banks are still feeling the sting from the industry-wide turmoil, and a fresh banking sell-off gripped markets on Friday morning as shares of Deutsche Bank tumbled, reigniting worries about a broader financial crisis.