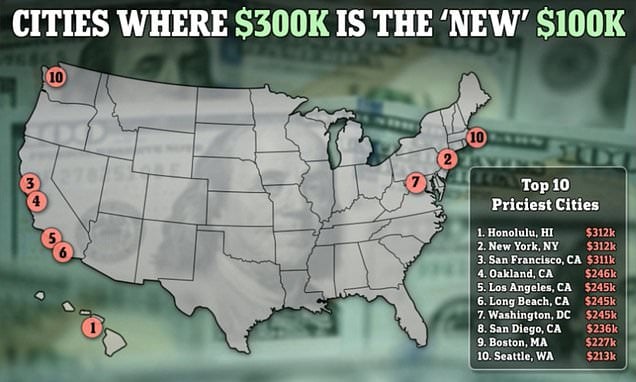

"Maximizing $100K: Where It Goes the Furthest and Why High-Earners Are Budgeting More"

A study by SmartAsset reveals that the purchasing power of a $100,000 salary varies significantly across U.S. cities, with the least value found in Manhattan, New York, where it's effectively worth $30,914 due to high living costs and taxes. In contrast, the same salary goes the furthest in El Paso, Texas, with a purchasing power of $88,840, attributed to lower living costs and no state or local income taxes. The study highlights the impact of cost of living on salaries in different cities, showcasing the stark differences in purchasing power across the country.