Price Shock 2026: Everyday Purchases People Just Stopped Buying

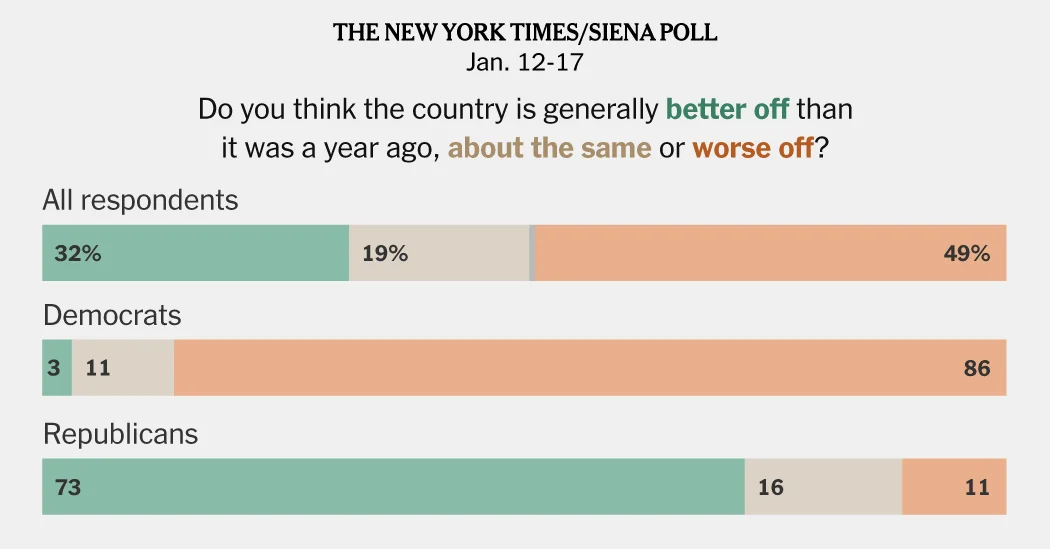

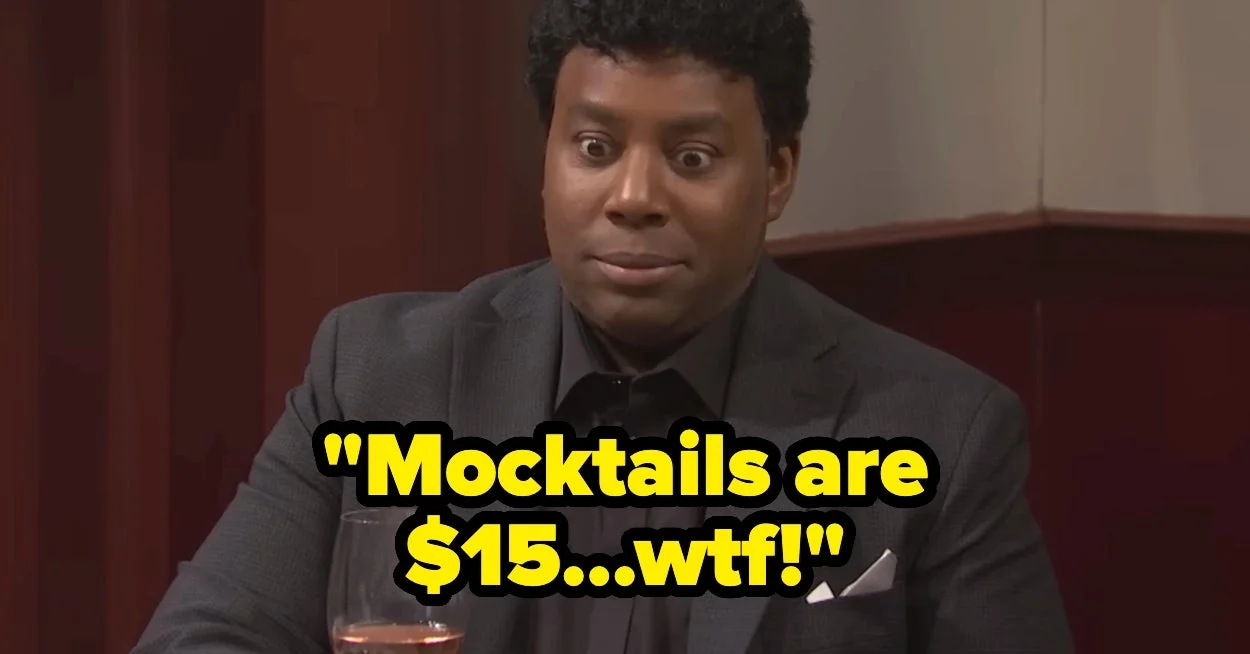

A BuzzFeed piece aggregating Reddit responses shows many people have stopped buying pricier items in 2026 due to inflation, from steak, concert tickets, and cocktails to cars, magazines, and haircuts, illustrating a broad shift in consumer spending as costs rise and people seek to cut back.