Oil Executives Skeptical of Trump's $100 Billion Venezuela Investment Plan

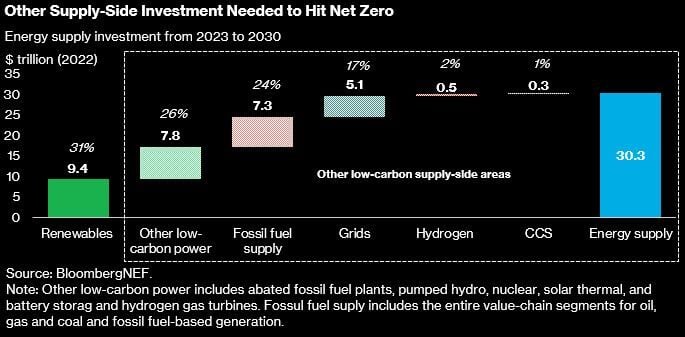

US oil executives are cautious about President Trump's push to invest $100 billion in Venezuela's oil sector, citing legal and security concerns, despite some companies showing interest. Trump aims to revive Venezuela's oil industry and leverage its reserves, but industry experts highlight the challenges and risks involved, including political instability and environmental issues.