Apollo and Global Asset Managers Hoard Cash Amid Market Turmoil

Apollo is reducing risk and increasing cash reserves in anticipation of potential market turmoil, indicating a cautious approach to upcoming economic uncertainties.

All articles tagged with #market turmoil

Apollo is reducing risk and increasing cash reserves in anticipation of potential market turmoil, indicating a cautious approach to upcoming economic uncertainties.

Private credit, once considered a 'golden' industry, faces scrutiny after Jamie Dimon’s comments comparing potential issues to cockroaches, leading to market concerns about credit risk and the stability of regional banks amid recent loan losses and warnings.

Gold prices are nearing $4,000 an ounce, marking its best year since 1979, driven by global investor anxiety, economic uncertainty, and geopolitical tensions, making gold a safe haven asset.

The article covers the emotional display of Chancellor Rachel Reeves during Prime Minister's Questions, which triggered market panic and political speculation about her future, alongside other headlines including NHS reforms, the Princess of Wales's cancer recovery, and Sean Combs's court case.

Private equity firms are shifting away from IPOs as their long-term downturn persists, opting for alternative exit strategies like business breakups and continuation funds due to market turmoil, high interest rates, and policy volatility, with some optimism about a potential market rebound.

JPMorgan CEO Jamie Dimon warned that the rising US national debt could lead to bond market turmoil, causing spreads to widen and negatively impacting small businesses and high-yield debt, highlighting concerns over potential economic instability.

Japan's bond market is experiencing rising long-term yields, sparking fears of capital outflows from the U.S. and a potential unwind of carry trades, which could lead to global market instability. The increase in yields is driven by structural factors and changing demand, raising concerns about a possible global financial crisis if confidence in safe assets erodes.

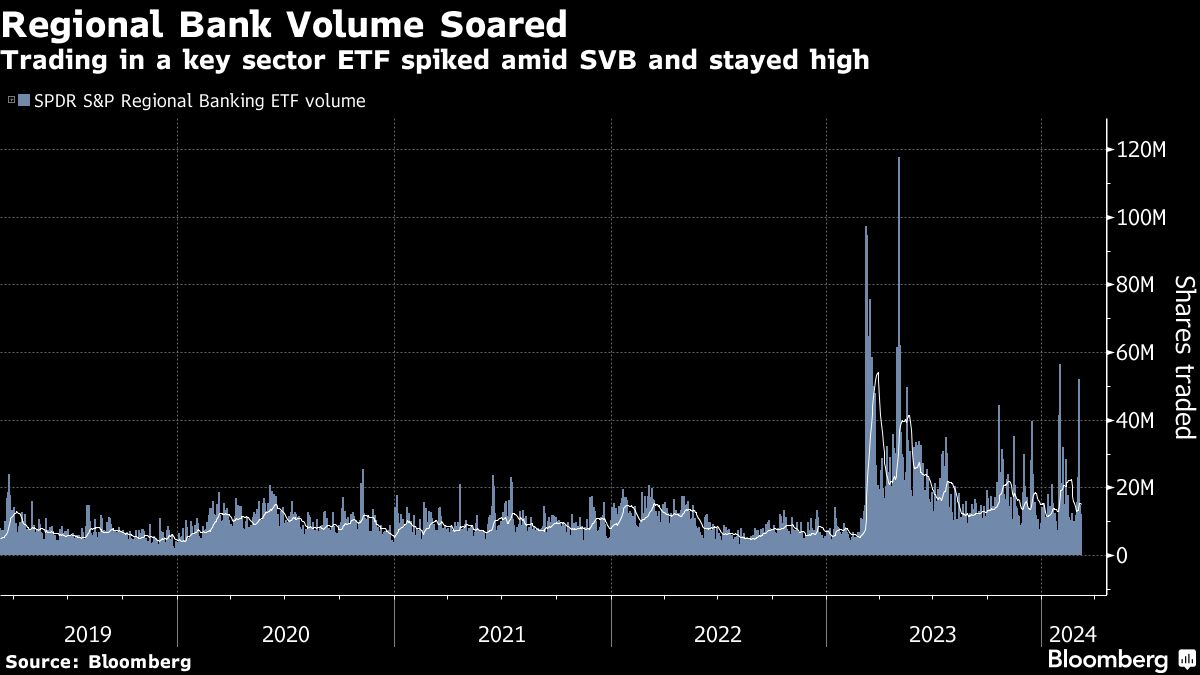

A year after the tumultuous collapse of Silicon Valley Bank, regional banks are back in focus as New York Community Bancorp faces a sharp drop in shares, prompting a $1 billion capital infusion led by former Treasury Secretary Steven Mnuchin. The market's reaction has been more contained this time, with analysts attributing NYCB's challenges as idiosyncratic. The collapse of SVB last year sparked market uncertainty and a drop in shares of its peers, but NYCB's recent turmoil is seen as a unique situation. The regional banking sector is grappling with tighter regulation and shifting public perception, with some investors finding opportunities in historically discounted bank stocks.

The U.S. Securities and Exchange Commission (SEC) warned that a government shutdown would severely impact its ability to approve companies' initial public offerings (IPOs) and respond to market turmoil. If Congress fails to pass funding legislation by Saturday, the SEC would operate with a "skeletal" staff, hindering its essential functions. SEC Chair Gary Gensler advised companies to go public before Friday if they are ready, as the agency's ability to review offerings would be frozen during a shutdown. The lackluster performance of recent high-profile IPOs has raised doubts about an IPO resurgence.

The Bank for International Settlements (BIS) has warned that hedge fund bets on US Treasuries could potentially lead to market turmoil. The BIS expressed concerns over the high levels of leverage used by hedge funds, which could amplify any sudden shifts in market sentiment. The warning comes as hedge funds have been increasing their positions in US Treasuries, betting on rising yields. The BIS emphasized the need for market participants to closely monitor and manage potential risks associated with these bets.

Binance, one of the world's largest cryptocurrency exchanges, is facing significant challenges as executives flee and layoffs increase. The company's reputation has been tarnished by regulatory scrutiny and market turmoil, leading to a wave of departures. Binance's future remains uncertain as it navigates these obstacles.

CNBC's Jim Cramer advises investors to be cautious when straying from the tech sector, which is currently the safest spot for their money due to the widespread turmoil in other industries such as energy, healthcare, real estate, and banks. Cramer attributes tech's immunity to the boon of generative AI. However, he also warns that the market is so narrow that straying from tech might continue to be the kiss of death in this market, at least until there is a cooling in the trillion-dollar colossus that is Nvidia.

Pacific Western Bank has lost nearly 10% of its deposits over the last week, amounting to billions of dollars, due to customers' fears of the safety of their deposits. The Los Angeles-based lender confirmed that it was looking to sell itself or raise more money, sending its shares down sharply. PacWest now has about $25 billion in deposits, compared with just over $28 billion at the end of March. The new pressure on PacWest is a reminder that midsize lenders remain under pressure, largely because their battered share prices are leading to worries among customers.

Blackstone's $70 billion real estate trust for wealthy individuals, Blackstone Real Estate Income Trust (BREIT), has limited redemptions for a sixth straight month, allowing only 29% of the $4.5 billion requested to be withdrawn in April. BREIT restricts withdrawals to about 2% monthly or 5% a quarter. The fund's performance was negative in Q1 2021 due to interest rate hedges falling in value when yields declined in March. BREIT is mostly invested in rental housing and industrial properties, sectors in which it sees stronger fundamentals and cash flows.

The market turmoil in March has caused many macro and trend-following hedge funds to suffer losses and cut bad portfolio bets. Algorithmic commodity trading advisor funds (CTAs) have also been hit hard, with losses of 6.8% this month. Hedge fund strategies based around macroeconomic ideas have also posted negative performances. The sudden collapse of two regional US banks and Swiss lender Credit Suisse has caught many hedge funds off-guard and left them with unexpected losses. CTAs have cut their entire long exposure of roughly $60 billion in equities in two weeks and are also cutting credit exposure.