"NYCB's Road to Recovery: Lessons from a Year of Turmoil"

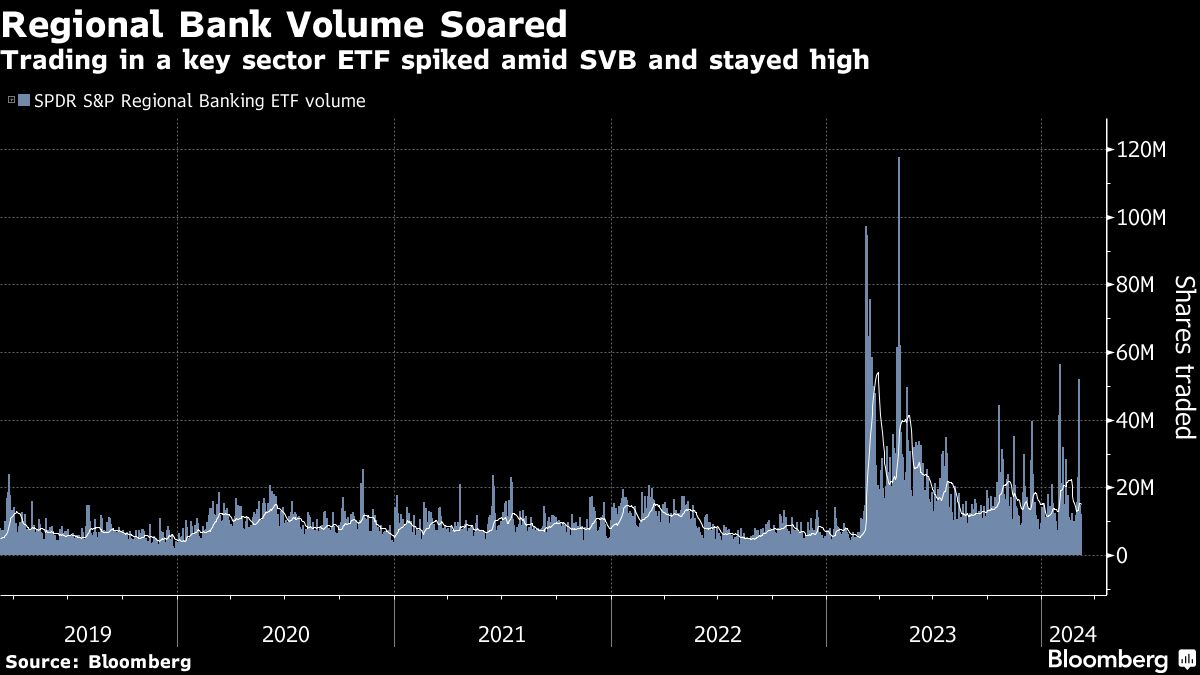

A year after the tumultuous collapse of Silicon Valley Bank, regional banks are back in focus as New York Community Bancorp faces a sharp drop in shares, prompting a $1 billion capital infusion led by former Treasury Secretary Steven Mnuchin. The market's reaction has been more contained this time, with analysts attributing NYCB's challenges as idiosyncratic. The collapse of SVB last year sparked market uncertainty and a drop in shares of its peers, but NYCB's recent turmoil is seen as a unique situation. The regional banking sector is grappling with tighter regulation and shifting public perception, with some investors finding opportunities in historically discounted bank stocks.

- A Year Since SVB's Tumult, NYCB Has Focus Back on Regional Banks Yahoo Finance

- Steve Mnuchin is betting regulators don't want NYCB to become another SVB Yahoo Finance

- Analysts take another look at troubled NY bank TheStreet

- NYCB says it lost 7% of deposits in the past month, slashes dividend to 1 cent CNBC

- NYCB Stock: Lessons From My Best And Worst Investment Ever Seeking Alpha

Reading Insights

0

9

5 min

vs 6 min read

90%

1,029 → 106 words

Want the full story? Read the original article

Read on Yahoo Finance