AI Uncovers Hidden Historical Climate Extremes

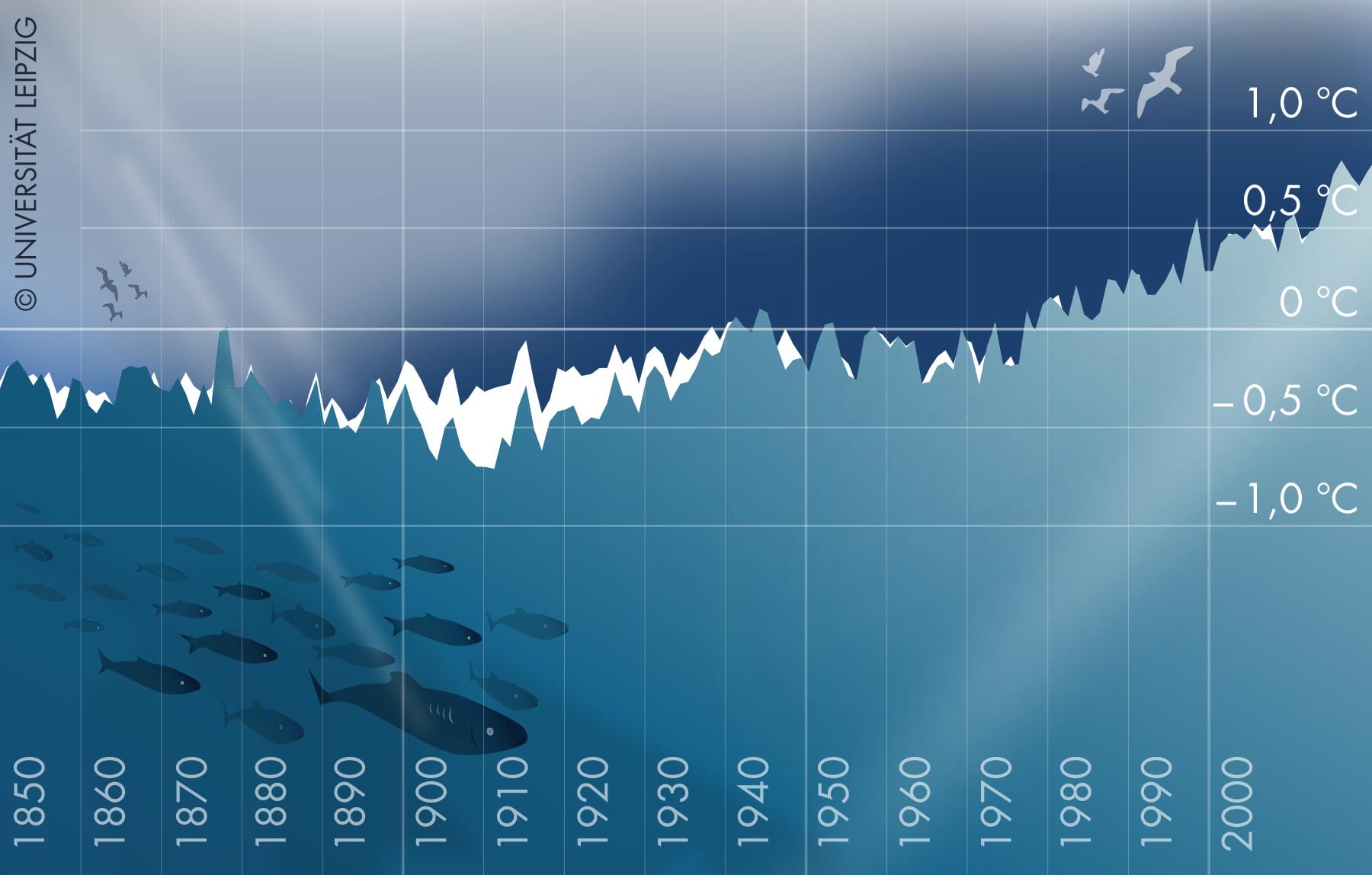

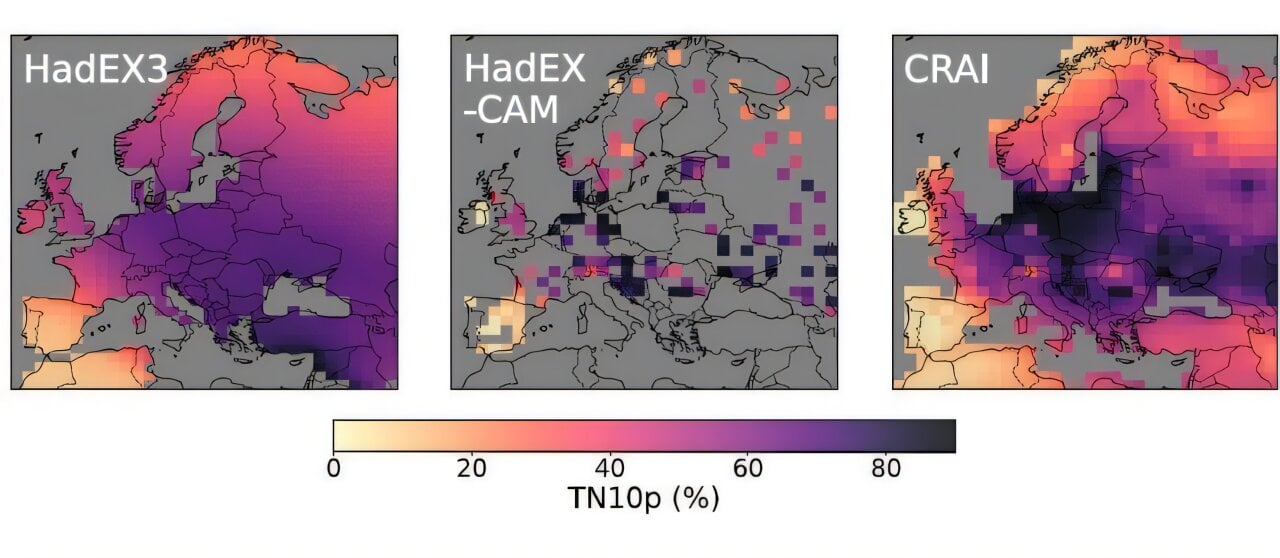

Researchers have utilized artificial intelligence to analyze historical climate data, uncovering previously undetected temperature extremes in Europe. The AI-based method, called Climate Reconstruction AI (CRAI), outperformed traditional statistical techniques in reconstructing past climate events, revealing unknown cold spells and heat waves. This approach highlights AI's potential to enhance understanding of climate extremes, especially in regions with sparse data, and suggests broader applications for global climate analysis.