Gold Miners Trigger 'Carbon Time Bomb' in Amazon Rainforest

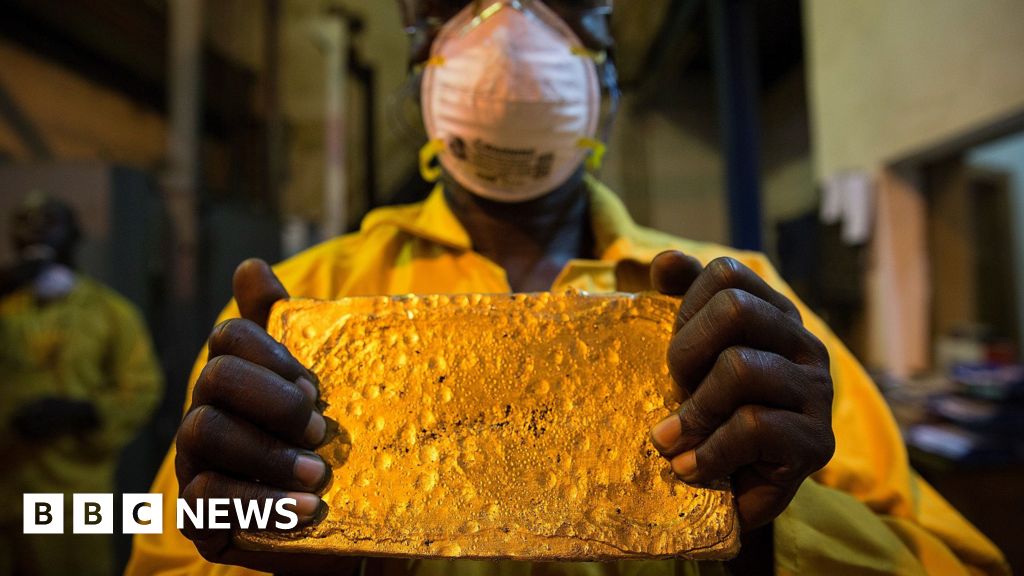

Gold mining in Peru's Amazon is rapidly destroying peatlands, which are crucial carbon sinks, leading to significant releases of stored carbon and threatening biodiversity, with potential emissions reaching millions of tons if current trends continue.