Global Economy News

The latest global economy stories, summarized by AI

Featured Global Economy Stories

G7 Unites Against China's Economic Threats

France's Finance Minister Bruno Le Maire warns that the global economy is at risk due to a surplus of cheap Chinese exports, a concern echoed by the Group of Seven. Le Maire emphasizes the need to address China's economic model, which he believes threatens not just the EU and the US, but the entire world economy.

More Top Stories

"Assessing Global Economic Recovery: Diverging Prospects and Uncertainty in 2024"

Financial Times•1 year ago

IMF Chief Urges Caution Amidst Weak Global Economy

Financial Times•1 year ago

More Global Economy Stories

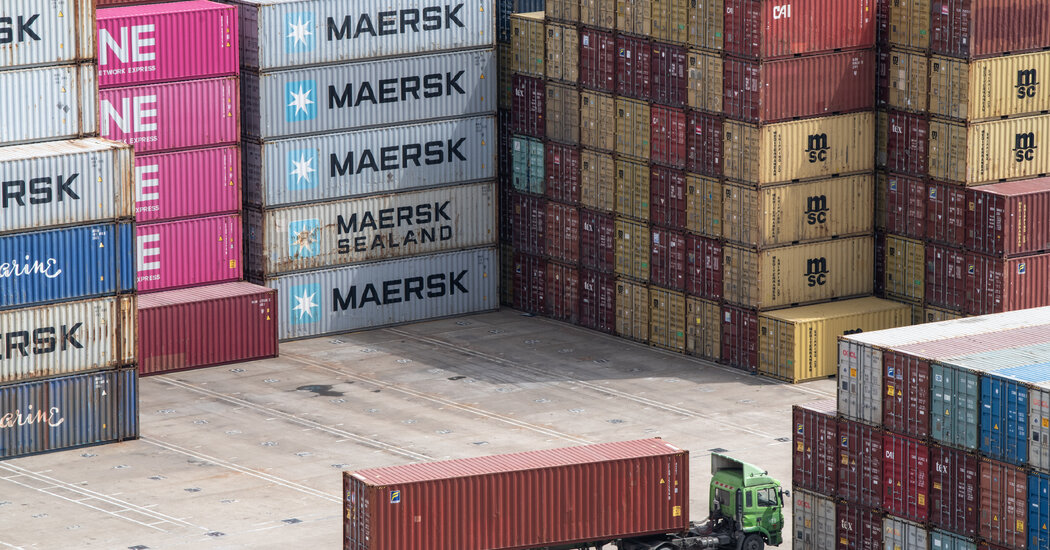

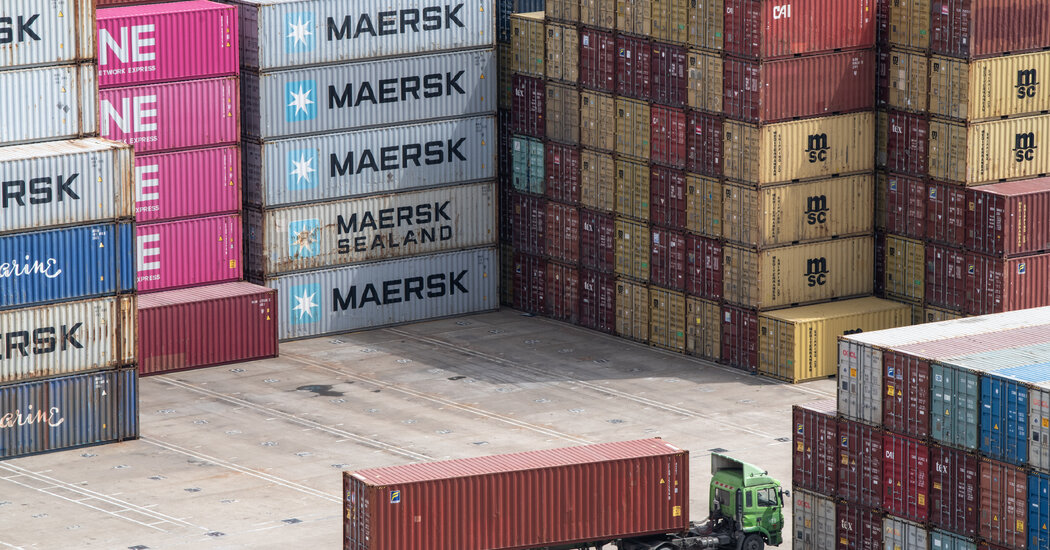

"OECD Warns of Inflation Risk Amid Red Sea Tensions"

The OECD warns that ongoing tensions in the Red Sea could lead to significantly higher inflation due to a 100% rise in seaborne freight rates, potentially increasing import price inflation across its 38 member countries by nearly 5 percentage points. Major shipping firms began diverting vessels away from Egypt's Suez Canal in late 2023, leading to longer journey times and capacity reduction in the global market. While the shipping industry had excess capacity last year, the OECD is closely monitoring the situation and notes positive data showing inflation coming down among its members. The organization also adjusted its economic growth forecast for the U.S., euro zone, and U.K.

IMF Upgrades Global Growth Forecast, Anticipates Inflation Retreat

The International Monetary Fund (IMF) has raised its global economic growth outlook, expecting a 3.1% growth rate in 2024 and 3.2% in 2025, with inflation projected to decrease. The U.S. is anticipated to experience a soft landing with a slowdown in growth, while the euro area may struggle. Global trade is projected to grow at a slower rate, and concerns persist about the banking system's exposure to commercial real estate. The IMF foresees central banks maintaining current interest rates until the second half of 2024, and notes a trend of increasing protectionist measures impacting globalization.

"IMF Raises Global Growth Forecast on US Resilience and China Policy Support"

The IMF has raised its global growth forecast for 2024 to 3.1%, citing the resilience of the U.S. economy and fiscal support in China, with large emerging markets also performing better than expected. Despite new risks from commodity price spikes and supply chain issues, the IMF sees a reduced likelihood of a "hard landing." Inflation is falling faster than expected, leading to the possibility of central banks easing policy rates in the second half of the year, but there is a risk of policy remaining too tight for too long, which could slow growth and bring inflation below 2% in advanced economies.

"Davos 2024: Embracing 'Glocalisation' and Optimism Amid Global Upheaval"

The World Economic Forum in Davos concluded with a panel discussing the state of the global economy, acknowledging that while most countries have outperformed expectations, there are challenges ahead. The global economy is facing fractures, with a grim struggle for economic supremacy between Washington and Beijing, widening gaps between north and south, and challenges to liberal democracy. Despite this, globalisation is not dead, but is evolving into "glocalisation," characterized by shorter supply chains, emphasis on domestic manufacturing, and a more strategic role for government. The shift towards onshoring previously outsourced production has been accelerated by recent events, leading to a growing interest in industrial policy and green growth plans.

"Global Carbon Tax Debated by World Leaders at World Economic Forum"

During a panel at the World Economic Forum, Singapore President Tharman Shanmugaratnam called for a global carbon tax as a solution to climate change, emphasizing the need for a coordinated system of carbon taxes, subsidies for vulnerable households, and funding for developing countries. Saudi Arabia's finance minister expressed agreement with the need for solutions to address climate change but highlighted challenges in implementing a carbon tax and redirecting funds to low-income countries. Germany's finance minister suggested a carbon market as an alternative to a carbon tax, proposing that countries could invest in renewable energy production in developing countries as part of emissions compensation.

Global Debt Reaches Record $88 Trillion, Prompting Fiscal Alarm

The Institute of International Finance's CEO, Tim Adams, has raised concerns about the record levels of global debt, emphasizing the urgent need for policymakers to address the "huge fiscal problem." With global debt reaching $307.4 trillion in the third quarter of 2023 and expected to rise further, Adams highlighted the risks posed by high debt levels, particularly in the context of aging populations and upcoming elections that could lead to increased populism. He stressed the importance of swiftly and intelligently addressing fiscal imbalances to avoid a potential crisis.

"2024 Economic Forecast: Navigating Global Threats and Opportunities"

As global leaders convene in Davos, the global economy in 2024 is expected to experience a soft landing with anticipated interest-rate cuts to bolster growth and markets worldwide. However, potential threats loom, including the impact of the Houthis, hyperinflation, and other risks stemming from years of conflict, pandemic, and financial instability.

"Global Impact: The Cost of a Chinese Invasion of Taiwan"

A Chinese invasion of Taiwan could cost the global economy US$10 trillion, equivalent to 10% of global GDP, with potential scenarios including a regional war drawing in the U.S. and a blockade severing Taiwan's trade with the world. The impact would lead to significant GDP declines for Taiwan, China, the U.S., and the world, surpassing losses from past crises such as the COVID-19 pandemic and the global financial crisis. If Taiwan were to face a blockade, the resulting global GDP losses would fall between the levels observed during the global financial crisis and the Gulf War.

"World Bank Warns of Worst Half-Decade for Global Economy in 30 Years"

The World Bank warns that the global economy is set to slow for the third consecutive year, with growth rates expected to be the weakest in 30 years. Despite progress in controlling inflation, the overall economic performance is lagging, and world leaders are likely to miss the 2030 development goals. The report highlights that a quarter of developing countries are now poorer than before the pandemic, and ongoing geopolitical tensions could further dampen global growth. The bank suggests that implementing policy changes, such as expanded trade and capital flows, could fuel an investment boom in developing countries and help improve economic prospects.

Developing Nations Face Escalating Debt Crisis, Warns World Bank

The World Bank warns that the debt costs of poor countries are reaching "crisis" levels, posing significant financial risks. The burden of debt is becoming increasingly unsustainable for these countries, with rising interest rates and declining economic growth exacerbating the problem. The World Bank calls for urgent action to address the issue and prevent a potential debt crisis.