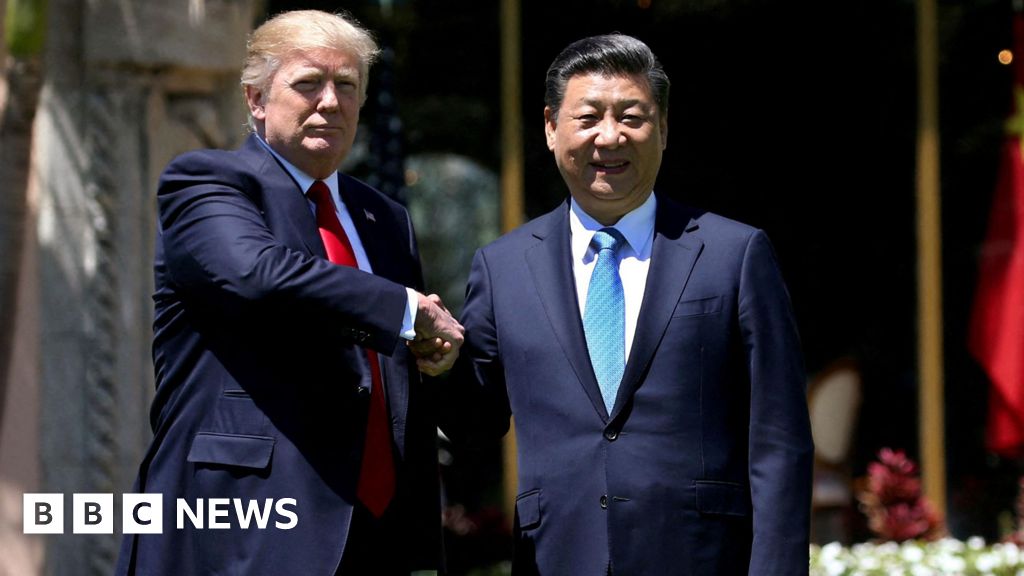

US-China Trade Deal and Its Impact on Rare Earths and Agriculture

A short-term US-China trade agreement has been reached, easing tensions by reducing tariffs, delaying restrictions on rare earth minerals, and promising increased Chinese purchases of US soybeans, with potential implications for TikTok's future ownership and broader economic sectors.