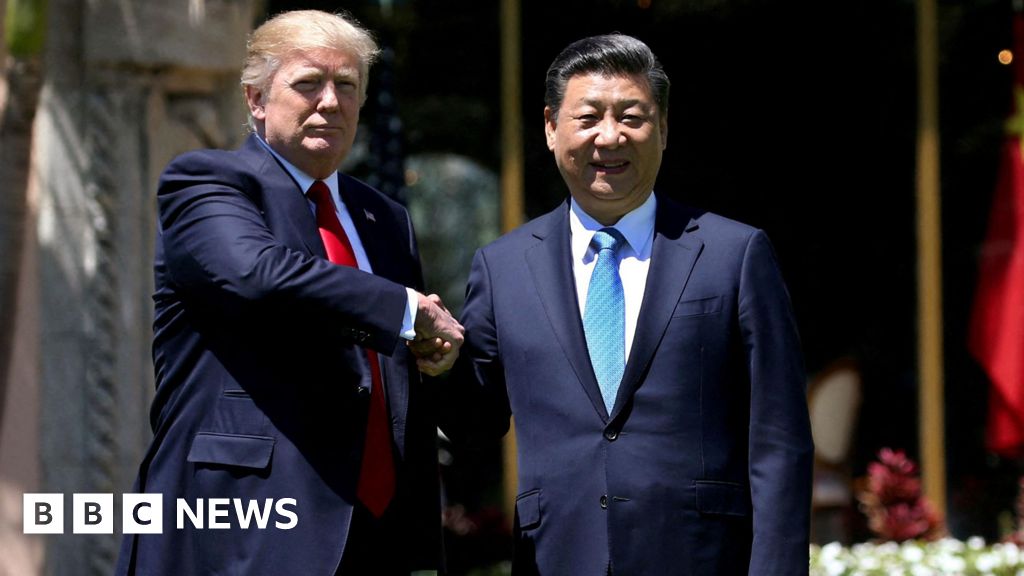

Trump Launches $12B Strategic Reserve for Critical Minerals

President Trump is initiating a $12 billion strategic stockpile of critical and rare earth minerals, funded by a $10 billion loan from the U.S. Export-Import Bank plus private capital, to reduce U.S. dependence on Chinese supplies and bolster manufacturing, defense, and tech supply chains, with minerals including cobalt, graphite, silicon, copper, nickel, titanium and lithium.