FedEx Joins Refund Push as Trump-Era Tariffs Are Ruled Illegal

FedEx, along with other U.S. companies, is seeking refunds from the government after a ruling that the Trump-era tariffs were illegal.

All articles tagged with #trade policy

FedEx, along with other U.S. companies, is seeking refunds from the government after a ruling that the Trump-era tariffs were illegal.

Following a Supreme Court ruling that blocked reciprocal tariffs, Trump invoked Section 122 of the Trade Act to impose a new 10% global tariff, later hinted to rise to 15%, creating widespread uncertainty for businesses and consumers as existing trade deals may be overridden, refunds for past levies remain unclear, and higher import costs could push prices higher, with UK exporters potentially facing billions in extra costs and firms considering diversification away from the US.

A tariff ruling has added new uncertainty to US-China trade relations, signaling possible policy shifts and prompting businesses and markets to reassess expectations as Washington and Beijing navigate tariffs amid ongoing tensions.

President Trump says he will raise the global tariff from 10% to 15% after the Supreme Court voided the prior authority; the 15% levy would be temporary (up to 150 days) under the Trade Act of 1974 and could be expanded under other laws, with analysts noting such tariffs could raise costs for American households (Yale Budget Lab estimates about $1,315 per year).

President Trump announced on social media that the global tariff will rise to 15% and take effect immediately, continuing his aggressive tariff strategy after the Supreme Court invalidated earlier duties. The 15% rate replaces the prior 10% rate with some exemptions (agriculture, Canada–Mexico under USMCA, certain Central American deals) and will apply to all other countries, while the administration signals use of other powers like Section 301 and Section 232 for further tariffs. The move aims to pressure allies and rivals to strike favorable terms, but risks higher costs for American consumers and businesses.

The Supreme Court ruled that Trump exceeded his authority with emergency tariffs, ending that chapter but Trump vows to reimpose tariffs within the law, signaling a new era of uncertainty for the U.S. economy.

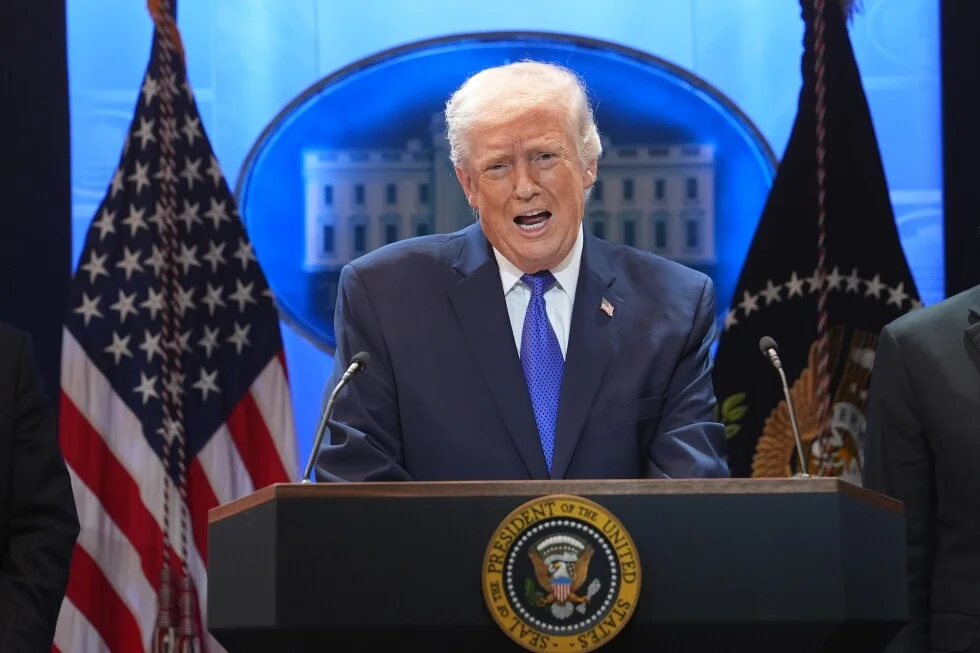

President Donald Trump said he will raise tariffs to 15% following a Supreme Court ruling, signaling a hard-line shift on trade and outlining the move during a White House press briefing.

The Supreme Court has struck down the Trump-era tariffs, setting the stage for refunds to importers. The ruling kicks off a complex, multi-agency process to determine eligibility, calculate amounts, and issue refunds, with businesses and the government awaiting detailed procedures and timelines.

The White House announced it will end the de minimis exemption that lets low-value Chinese shipments under $800 enter the U.S. duty-free, a policy Trump says has fueled opioid trafficking, and the move comes after the Supreme Court struck down a significant portion of his tariffs.

The Supreme Court ruled that most of Trump’s tariffs were invalid because he overstepped his authority, but that won’t automatically lower consumer prices and it remains unclear whether businesses will get refunds for tariffs paid last year.

The Supreme Court ruled 6-3 against President Trump's global tariffs, striking down his unilateral tariff plan and signaling a major constraint on his economic agenda. The decision throws U.S. trade policy back into uncertainty, and Trump criticized the ruling as deeply disappointing and shameful toward the justices.

U.S. officials are considering major changes to the U.S.-Mexico-Canada trade framework that could scrap or renegotiate it without Canada, using the opening of a new U.S.–Canada bridge as leverage to secure concessions. Such a move would disrupt established cross-border supply chains, upend business plans built around tri-country trade, and risk economic fallout for companies relying on the pact.

A new study finds tariffs paid by midsized U.S. firms tripled last year, signaling rising costs for middle-market companies as trade policy continues to shape the business environment.

White House economic adviser Kevin Hassett criticized a Federal Reserve Bank of New York study that found U.S. companies bear most of the costs of tariffs, calling the research an embarrassment and urging the central bank to punish the researchers behind it.

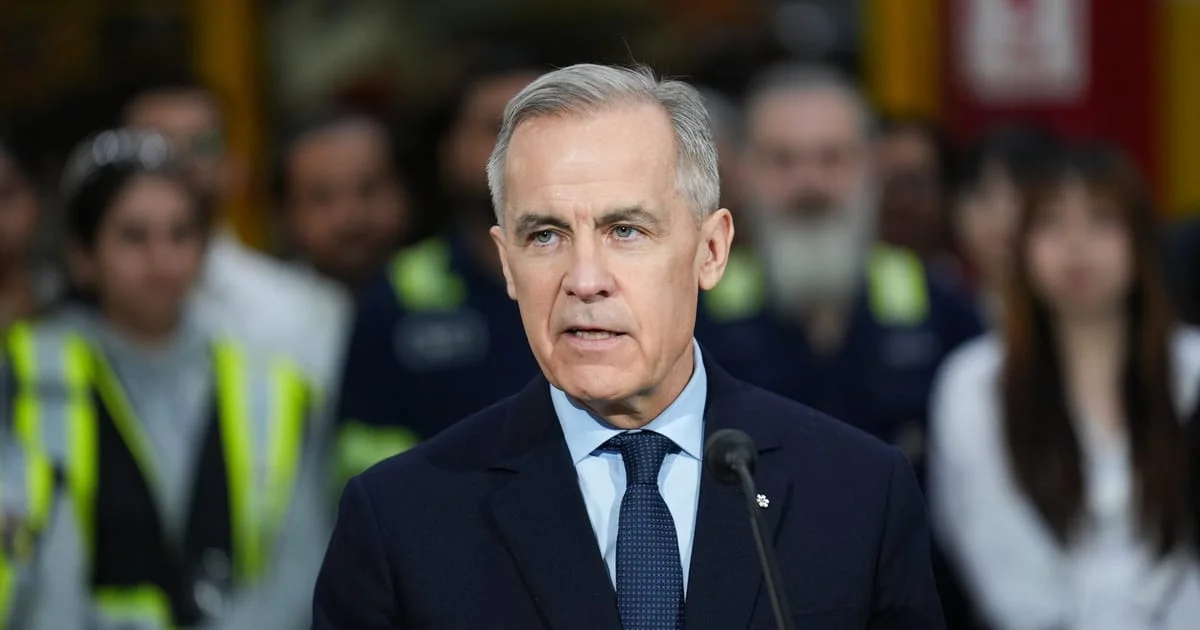

Canadian Prime Minister Mark Carney floated brokering a bridge between the EU and CPTPP to build a large, rules-based trade bloc that could counter Trump-era protectionism, signaling Ottawa’s push to deepen ties across the two blocs through cumulation rules and smoother cross-border trade.