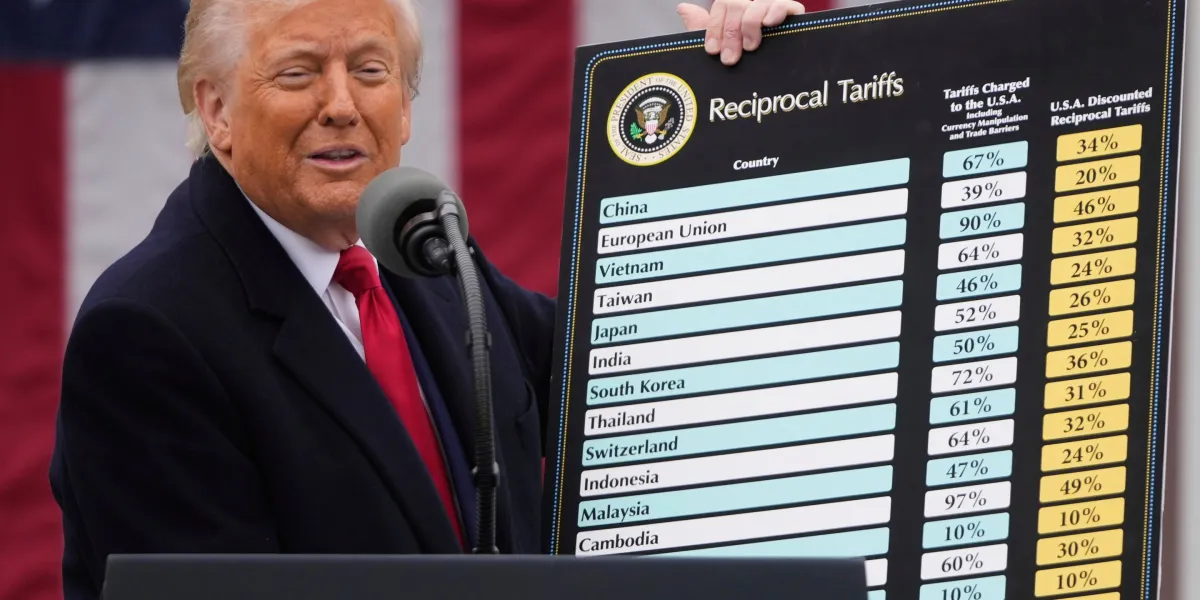

Trump's tariffs reduced the deficit but limited economic growth in 2025

Trump's tariffs in 2025 significantly increased the effective tariff rate, raising over $236 billion in revenue and contributing to a substantial reduction in the US trade deficit from a record $136.4 billion to $52.8 billion by September. While tariffs impacted global trade, especially with China, they also caused market volatility and higher prices for consumers and businesses.