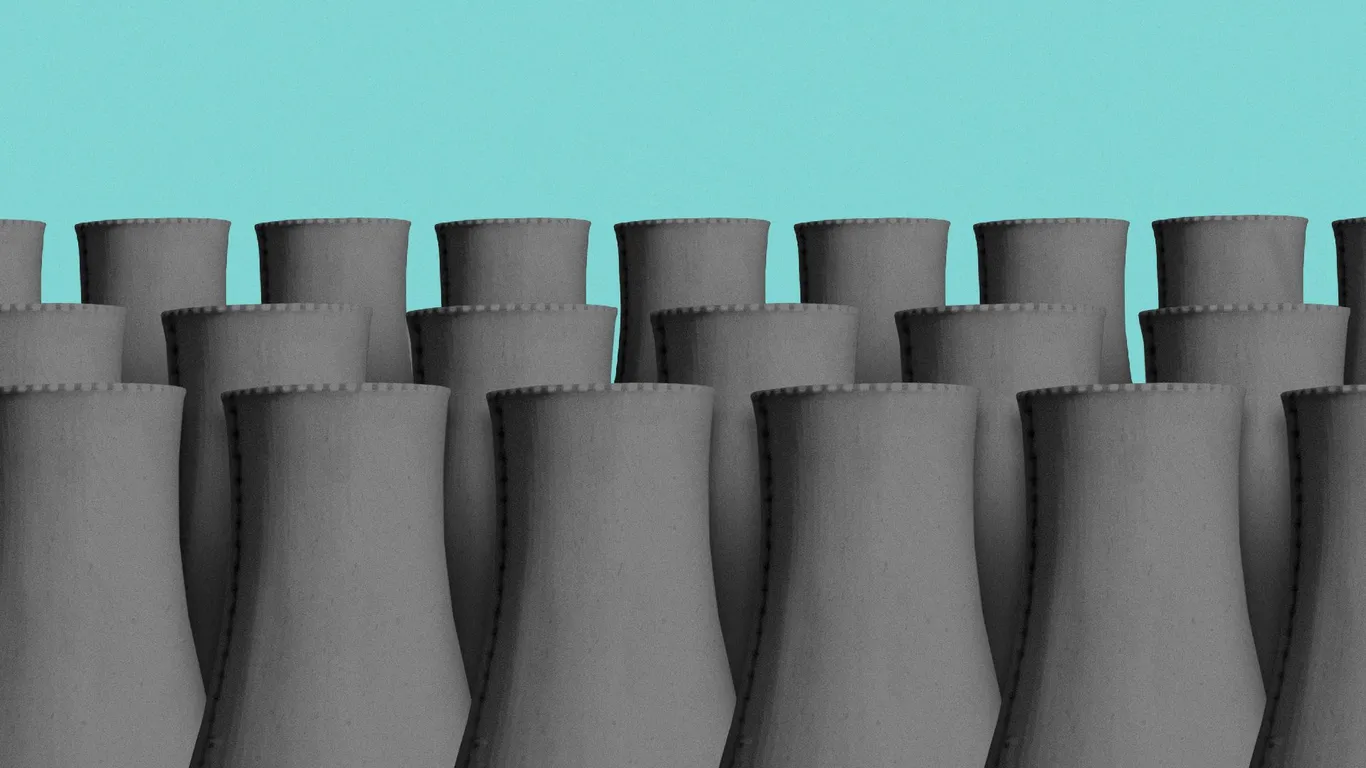

US-Hungary sign civil nuclear pact as Orbán deepens ties with Trump-era ally

The United States and Hungary formalized a civil nuclear cooperation agreement that will expand collaboration on civil nuclear energy, including small modular reactors and spent fuel management, with Hungary set to purchase U.S. nuclear fuel and Holtec International assisting on spent fuel; the pact diversifies Hungary’s energy away from Russia and strengthens U.S. influence in Europe ahead of elections, reflecting the close ties between Viktor Orbán and former President Donald Trump.